Posted on: May 8th, 2012 by Amy Bolger

If you died tomorrow, who would inherit your assets? Your house? Your Snapfish albums? If you’re like half of American adults with children, you haven’t made a will and therefore, legally speaking, haven’t answered these questions. If you died tomorrow, who would inherit your assets? Your house? Your Snapfish albums? If you’re like half of American adults with children, you haven’t made a will and therefore, legally speaking, haven’t answered these questions.

A survey from RocketLawyer.com, a legal services web site, last month found that 50% of Americans with children do not have a will. Even more alarming, 41% of baby boomers (age 55-64) don’t have one. The top three reasons cited by survey respondents for not having a will: procrastination, a belief that they don’t need one, and cost.

So what happens if you die without a will? The state will decide how your property is distributed. The state will sometimes decide in the favor of those intentioned to receive items, other times not.

Shifts in demographic patterns are making estate plans even more critical. As the survey notes, in the past five years the number of unmarried couples has jumped, according to the National Marriage Project. Throw a child into the mix and the surviving partner doesn’t get the same protections that are default under law for a married couple.

Don’t forget your ‘digital estate’

And no doubt you’ve heard about the digital afterlife. According to the RocketLawyer survey, 63% of respondents don’t know what happens to their digital assets when they die. Traditional estate planning doesn’t take into account this emerging class of assets — and it’s not just thinking about what you want to happen to your Facebook page or Match.com profile.

Your survivors may not even be aware of the extent of your online presence. Consider your online bank accounts, email accounts, iPod and all its music, blogs, photo albums, YouTube account, eBay account, PayPal account, e-book collection, Gilt Group subscription…you get the picture. Even your U.S. savings bonds are online.

Most popular online account services like Facebook, Gmail, LinkedIn and Twitter have developed deceased-user policies, which provide the family or executor of the deceased user with information about what’s required to access the account. This, however, is a problem most people don’t know that they have.

How to create a will: a primer

– List your significant assets, financial advisors, retirement plans, divorce papers, premarital agreements, and any other such documents.

– Gather employment benefits statements, life insurance policies, deeds to real property, partnership and business agreements and the last two years of income tax returns.

– If you’re married, each spouse makes a separate will.

– Decide who will inherit your property. After you make your first choices, choose alternate beneficiaries, too, in case your first choices don’t survive you.

– Choose an executor to handle your estate. Every will must name someone to serve as executor, to carry out the terms of the will. Be sure to let that person know you want them to serve as the executor so it’s not a surprise.

– Identify a guardian for your children. If your children are under 18, decide who you want to raise them in the event that you and their other parent can’t. You should also pick someone who can manage your children’s property.

– Identify other decision makers to carry out your health & money choices for you if you’re incapacitated.

– With that information, you can create a will online (there are plenty of online options and tips), or hire an estate planning attorney to help you (they can charge hourly rates of $100 to $500 or more)

Tags: demographic patterns, digital assets, linkedin, national marriage project, online bank accounts, user policies

Posted in Financial Planning Rockville |

No Comments »

Posted on: March 7th, 2012 by Amy Bolger

Well, apparently Peyton Manning isn’t worth the $28 million that Indianapolis Colts were due to pay him come March 8. At least he isn’t with the condition his neck is in. ESPN reports that the star quarterback will be cut by the Indianapolis Colts and it will be announced at a press conference on March 7 (just one day before he is due his $28 million roster bonus). Now that Peyton Manning will be a free agent, many topics come into play – will he retire or will he continue to play? Where will he sign? Does he still have what it takes to compete? Well, apparently Peyton Manning isn’t worth the $28 million that Indianapolis Colts were due to pay him come March 8. At least he isn’t with the condition his neck is in. ESPN reports that the star quarterback will be cut by the Indianapolis Colts and it will be announced at a press conference on March 7 (just one day before he is due his $28 million roster bonus). Now that Peyton Manning will be a free agent, many topics come into play – will he retire or will he continue to play? Where will he sign? Does he still have what it takes to compete?

All of these questions are going to be asked until something new develops with Manning. As reported by Yahoo! sports contributor, David Mehrwein, here are his answers to those questions:

Will Peyton Retire?

“No, I don’t believe Peyton Manning will retire. He doesn’t want to retire and having earned the status he has in the NFL, I think that teams will overlook the fact that he may not be 100 percent. If anything, Manning will continue to play the game of football because that’s what he wants to do. Do I think it’s smart of him to play if he is not fully recovered? No, I don’t, but it’s not my decision, it is Peyton’s. Besides, he’s been cleared by the doctors to play and most likely will.”

Where will he sign?

“This is the million-dollar question. There are a few teams that come to mind when I think of where Manning would fit nicely. I think the New York Jets, Seattle Seahawks, and Miami Dolphins may all be good fits. The Jets need a leader at quarterback and Manning would certainly fit that role. The Seahawks have a great running back and good receivers, but Tarvaris Jackson is not going to lead the Seahawks anywhere anytime soon. Lastly, the Dolphins are a team that can compete with a strong quarterback – just imagine what Brandon Marshall could do with Manning at QB.”

Can he still compete?

“As I stated earlier, the doctors have cleared him to play and Manning wants to play. I don’t think Manning would go out there if he thought he couldn’t compete anymore. He may have to regain some strength in his throwing arm, but his ability to tear apart a defense should still be readily intact. Not only can he compete, I think he makes many teams instantly better.”

Tags: indianapolis colts, miami dolphins, new york jets, nfl, peyton manning, seattle seahawks, star quarterback

Posted in Latest News |

No Comments »

Posted on: February 17th, 2012 by Amy Bolger

A large group of recently graduated and unemployed lawyers are suing their law schools for false hope. A total of 75 alumni have filed at least 15 class-action lawsuits across the country, accusing their law schools of inflating employment and salary data to attract prospective students. The New York Daily News reported that graduates from the Brooklyn Law School accuse the school of fraud, saying that “attending Brooklyn Law and forking nearly $150,000 in tuition payments is a terrible investment.”

The school’s Web site reported employment rates of 88 to 98 percent within nine months of graduation, but the students allege these figures included students who had part-time or temporary work unrelated to the legal field, according to the Daily News. The school’s Web site reported employment rates of 88 to 98 percent within nine months of graduation, but the students allege these figures included students who had part-time or temporary work unrelated to the legal field, according to the Daily News.

Recent graduates from New York Law School filed a $200 million class action suit in damages for fraud, negligent misrepresentation, and violations of business law.

Financial writer Flexo, at Consumerism Commentary, says that the goal of the lawsuits seem not to merely receive compensation, but to ” effect systemic change in the education industry and associations that accredit law schools”, like the American Bar Association. He also says it’ll be hard for the students to win their case, since there are many “factors that contribute to unemployment, including the overall economy, local job markets, and the effort, skills, and self-marketability of each alumnus.

Tags: brooklyn law school, class action lawsuits, class action suit, employment rates, financial writer, marketability, recent graduates, salary data, tuition payments

Posted in Financial Planning Rockville |

No Comments »

Posted on: February 15th, 2012 by Amy Bolger

WHEN confronted by a letter from the Internal Revenue Service, some people look at is as though they’ve seen a ghost. BOO! WHEN confronted by a letter from the Internal Revenue Service, some people look at is as though they’ve seen a ghost. BOO!

And when they open certain letters, a few people do see a ghost — or, more accurately, the ghost of a tax return.

When the IRS detects that a person had reportable income but did not file a return, even after much cajoling, it steps in and does the job itself. Based on what it knows, the agency prepares what it calls a “substitute for return”, a Form 1040 (the generic tax return). It lists income, calculates the tax due, adds interest and a penalty for failing to file, and sends the recalcitrant taxpayer a bill based on its efforts.

In one way, that may be a relief to procrastinators who just didn’t get around to filing, perhaps for years. But it often comes at a VERY high price.

Substitute returns are really no substitute for ones that taxpayers could have filed themselves. That’s because the IRS uses data from only the income side when it creates such a return, which means that it doesn’t include all kinds of items that might offset that income, according to Julian Block, a tax lawyer in Larchmont, N.Y.

The IRS works from W-2 reports of wages paid, filed by employers, and reports of payments to self-employed people from companies that used their services. The agency also uses reports from financial institutions about interest and dividends paid and reports from brokers about assets sold. All these things are taxable income.

For self-employed people, in particular, there is often a big disparity between payments received and taxable income, because much of what they receive goes for supplies or salaries or other expenses. But the IRS will know only the gross payment, and will plug that figure into its return. It does not even know about the original cost of assets that were reported sold.

In other words, the IRS does not include many of the deductions to which a non-filer may be entitled. But this doesn’t mean that the IRS is being mean or vengeful or evil.

The IRS is candid that it does not even look for deductions. In a fact sheet in what it calls the “tax gap” series on its Web site, the IRS warns that a substitute return it prepares is a “basic” one that “will not include any of your additional exemptions or expenses.”

The IRS investigates about a million “non-filer situations” a year. But it does not prepare a substitute return for everyone that it believes failed to file. People in the underground economy do not leave a trail that can contribute to such a return, tax experts have been noted as saying. If those people are caught, they may not get an official printout in the mail. A visit from someone who dangles handcuffs from a belt is more likely. And the IRS substitute is not used when a taxpayer has filed a return but the agency believes that he or she failed to report some income. It has other methods for resolving those issues — often an audit… just what we all have time for!

A taxpayer prompted to action by a substitute return can file the return that he or she should have filed in the first place, and the IRS will adjust the taxpayer’s account accordingly. The next step, in which taxpayers can claim their exemptions and deductions, can sharply cut the amount due or even yield a refund. Many nonfilers wouldn’t owe large amounts if their returns were done properly. The IRS fact sheet says its research shows that such failures “could simply be due to procrastination”, as stated by Mr. Eric Bach, CPA.

ONCE a ghost return appears in the mail, simply avoiding it isn’t a viable option. The IRS will send reminders. If there is no response, it will start collection efforts, based on its calculations.

“The worst thing a taxpayer can do, is not file a return and then continue to ignore the repeated letters from the IRS”, Mr. Bach said.

But taxpayers sometimes do just that, provoked by “fear, paralysis, and denial”, as Mr. Bach has stated it. “The most important point to remember is that the substitute returns only reflect the income and some some expense information such as mortgage interest because they are required to be reported to the IRS. These returns are not final. When the actual return is filed, it supercedes the ‘ghost return’. This is very important to remember because the actual return will include your itemized deductions that may substantially reduce the IRS’ original assessment.” In essence, Mr. Bach’s point is, file your returns as quickly as possible if a “ghost return” has been filed to, not only reduce your tax debt and possibly eliminate it, but also to minimize penalties.

Unpleasant as it may be to file a tax return, and paying the bill to begin with… filing may prove much more appealing than the alternatives.

Tags: ghost return, internal revenue service, irs, linkedin, tax lawyer, tax return, taxable income

Posted in CPA Rockvile |

No Comments »

Posted on: February 15th, 2012 by Amy Bolger

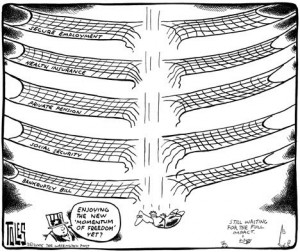

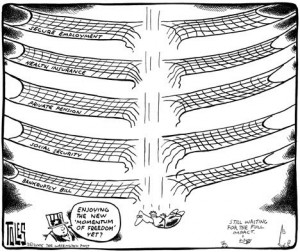

A new analysis from the Center on Budget and Policy Priorities underscores that the poor are no longer the primary beneficiaries of the government safety net. Terms like entitlements, government benefits, and safety net often conjure images of tax dollars sliding from the hands of the wealthy into the pockets of the poor. But as reported by The New York Times, Saturday, that image is badly outdated. Benefits are now flow primarily to the middle class.

The center’s study found that the poorest American households, the bottom fifth, received just 32 cents of every dollar of government benefits distributed in 2010. The finding is broadly consistent with the data reported Sunday that the poorest households received 36 percent of benefits in 2007, down from 54 percent in 1979, numbers that came from a study published last year by the Congressional Budget Office.

While the findings are not directly comparable because of differences in methodology, the new study suggests that the recent recession did not cause any significant increase in the share of benefits flowing to the poor, as might once have been expected. The study found that older people received slightly more than half of government benefits, while the non-elderly with disabilities received an additional 20 percent. These benefits are not means tested, but rather, better-paid workers get more in Social Security.

Furthermore, the study notes that politicians have shifted benefits away from the “jobless poor,” through reductions in traditional welfare, and increased benefits for working families, for example through tax credits. The government also also expanded elegibility for benefit programs.

“The safety net became much more work-based,” wrote Arloc Sherman and his collaborators at the center, a left-leaning research group. “In addition, the U.S. population is aging, which raises the share of benefits going to seniors and people with disabilities.”

Another finding of the study is that the distribution of benefits no longer aligns with the demography of poverty. African-Americans, who make up 22 percent of the poor, receive 14 percent of government benefits, close to their 12 percent population share. White non-Hispanics, who make up 42 percent of the poor, receive 69 percent of government benefits… again, much closer to their 64 percent population share.

Tags: benefit programs, center on budget and policy, congressional budget office, government benefits, linkedin, middle class, priorities, tax credits, tax dollars, working families

Posted in CPA Rockvile |

No Comments »

Posted on: February 8th, 2012 by Amy Bolger

Eric L. Bach & Associates – Yes, filing your taxes can be trying and extremely annoying… therefor we like to put the whole ordeal off until the last possible moment. Other than getting your refund sooner or having more time to gather up the funds to pay your tax bill, there is another good reason to get your taxes done early: identity theft. Simply, this is when someone gets your Social Security number or other identifying information and forges a tax return in your name to get a refund. Eric L. Bach & Associates – Yes, filing your taxes can be trying and extremely annoying… therefor we like to put the whole ordeal off until the last possible moment. Other than getting your refund sooner or having more time to gather up the funds to pay your tax bill, there is another good reason to get your taxes done early: identity theft. Simply, this is when someone gets your Social Security number or other identifying information and forges a tax return in your name to get a refund.

It’s understandable that many people don’t want to deal with the IRS because it can be a very trying experience. But, just imagine how frustrated you would be if you found out someone had filed a false tax return using information stolen from you. Identity thieves will often submit their fake returns early in the filing season before the victim finishes their real return.

Tax refund identity theft is a growing problem. In 2010, the IRS was able to identify and remove almost 49,000 returns seeking fraudulent refunds. Last year, it removed 262,000 fraudulent returns. The IRS is taking every step they can to try to combat this problem. If you suspect you are a victim of identity theft, contact the IRS Identity Protection Specialized Unit at 800-908-4490. You will then be asked to complete IRS Form 14039, the identity-theft affidavit. Also, remember that the IRS will not contact you by email to request any personal or financial information. If you get any such message, delete immediately. Do not, however, dismiss IRS notices you receive in the mail that indicate that more than one tax return was filed for you.

Tags: fraudulent returns, irs notices, linkedin, social security, tax refund, tax return, victim of identity theft

Posted in CPA Rockvile |

No Comments »

Posted on: February 1st, 2012 by Amy Bolger

Don Cornelius, the creator of ‘Soul Train’, was found dead in his home this morning. Officers responding to a report of a shooting found Cornelius at his Mulholland Drive home at around 4 am, police said. He was pronounced dead of a self-inflicted gunshot wound at 4:56 am at Cedars-Sinai Medical Center, said Los Angeles County Assistant Chief Coroner Ed Winter. Don Cornelius, the creator of ‘Soul Train’, was found dead in his home this morning. Officers responding to a report of a shooting found Cornelius at his Mulholland Drive home at around 4 am, police said. He was pronounced dead of a self-inflicted gunshot wound at 4:56 am at Cedars-Sinai Medical Center, said Los Angeles County Assistant Chief Coroner Ed Winter.

“I am shocked and deeply saddened at the sudden passing of my friend, colleague, and business partner Don Cornelius,” said Quincy Jones. “Don was a visionary pioneer and a giant in our business. Before MTV there was ‘Soul Train,’ that will be the great legacy of Don Cornelius. His contributions to television, music and our culture as a whole will never be matched. My heart goes out to Don’s family and loved ones.”

With the creation of ‘Soul Train’, Cornelius helped break down racial barriers and broaden the reach of black culture with funky music, groovy dance steps and cutting edge style. It introduced television audiences to such legendary artists as Aretha Franklin, Marvin Gaye, and Barry White. It brought the best R&B, soul, and later hip-hop acts to TV and had teenagers dance to them. It was one of the first shows to showcase African-Americans prominently, although the dance group was racially mixed. Cornelius was the first host and executive producer.

Tags: don cornelius soul train, funky music, quincy jones

Posted in Latest News |

No Comments »

Posted on: January 25th, 2012 by Amy Bolger

10 yrs. ago, the kidnapping of Elizabeth Smart left Americans glued to their televisions and completely engrossed in the story. Now, Elizabeth is 24, and has just announced her engagement. I’m sure, as I was, most people were a little shocked, then excited that she had found someone and wasn’t nearly as damaged as one would have thought, and then wanted to know, who is this guy? The Smart family tried to keep him a secret… but that, obviously, did not work. He has been identified as Matthew Gilmour, a 21-year old from Scotland. 10 yrs. ago, the kidnapping of Elizabeth Smart left Americans glued to their televisions and completely engrossed in the story. Now, Elizabeth is 24, and has just announced her engagement. I’m sure, as I was, most people were a little shocked, then excited that she had found someone and wasn’t nearly as damaged as one would have thought, and then wanted to know, who is this guy? The Smart family tried to keep him a secret… but that, obviously, did not work. He has been identified as Matthew Gilmour, a 21-year old from Scotland.

The couple met in France, while Elizabeth was there serving a mission for the LDS church. Gilmour shares her Mormon faith and connection to music. He is the son of 2 music teachers and his late father once played in a brass band. Smart is a harp major at BYU.

The couple plans to wed in July, according to Smart’s hometown paper, The Salt Lake Tribune. They described both Smart and her parents as very excited about the impending marriage. The family plans to keep details of the big day private.

Tags: elizabeth smart, fiance, impending marriage, salt lake tribune, smart family

Posted in Latest News |

No Comments »

Posted on: January 25th, 2012 by Amy Bolger

Joe Paterno’s family announced Monday that the legendary football coach will get a two-day viewing and a public memorial this week on the Penn State campus, two months after the university fired him over the phone. The legendary coach had been linked to the Jerry Sandusky scandal and had allegedly not taken all the proper steps to put a stop to the reported behavior. Joe Paterno’s family announced Monday that the legendary football coach will get a two-day viewing and a public memorial this week on the Penn State campus, two months after the university fired him over the phone. The legendary coach had been linked to the Jerry Sandusky scandal and had allegedly not taken all the proper steps to put a stop to the reported behavior.

Bitterness over Paterno’s removal has turned up in many forms, from online postings to a note placed next to Paterno’s statue at the football stadium blaming the trustees for his death. A newspaper headline that read “FIRED” was crossed out and made to read, “Killed by Trustees.” Lanny Davis, lawyer for the board, said threats have been made against the trustees.

The family gave no details as to who might be invited or asked to speak at the memorial Thursday at the basketball arena, which can hold 16,000 people. Penn State spokeswoman Lisa Powers said the specifics were still being worked out with the Paternos. But many alumni and students say Paterno was treated shabbily by the Board of Trustees in November, and trustees and other members of the administration might not be made to feel welcome at the memorial for the 85-year-old coach, who died Sunday of lung cancer. At this point, it seems the Board of Trustees has completely alienated itself from State College and the Penn State community.

“I don’t think it’s going to be heavily laden with administration and trustees,” said trustee Linda Strumpf, who lives in New York and will not attend. “This is something the family is putting together and not the university. I don’t think the university wants to be in a position to tell them what a memorial service looks like.” Sounds rather cold-hearted considering all that Paterno did for the university.

But trustee Al Clemens said he will be there to honor a man he described as a good friend. “This is really a family thing, and so we’re just going to go as individuals,” Clemens said. “Joe’s a great guy. No matter what the situation was in the last two months, it doesn’t take away from what he’s done through history for so many people. He’s just been tremendous.”

The viewing will be held Tuesday and Wednesday at a campus spiritual center, followed by a private funeral Wednesday afternoon. The public memorial will be at the Jordan Center and is expected to draw thousands.

Janice Hume, a journalism professor at the University of Georgia, said that staging an appropriate memorial creates a dilemma similar to the one faced by Paterno’s obituary writers: how to address the scandal without letting it negate his entire career. “I think it’s probably very difficult to strike the right balance,” she said.

Clemens said the board will later consider more lasting tributes to Paterno, including scholarships in his name. Because of his generosity to the school, his family name is already on the library and a spiritual center.

There has also been a movement over the past few years to change the name of Beaver Stadium, the football team’s home field, to Joe Paterno Field at Beaver Stadium, and on Monday the man behind it, Warren W. Armstrong, a 1960 graduate and retired Allentown advertising executive, said he would renew his efforts. Some are suggesting renaming the street leading to the stadium Paterno Way.

A family spokesman said the Paternos’ focus this week is on the viewing and funeral plans and they do want to weigh in on any ideas for a permanent memorial right now. But “I would say the family would welcome a conversation on that,” Dan McGinn said.

RIP JoePa.

Tags: board of trustees, joe paterno, JoePa, legendary football coach, linkedin, penn state campus, penn state community, scandal

Posted in Latest News |

No Comments »

Posted on: January 5th, 2012 by Amy Bolger

For the second year in a row, the IRS is giving taxpayers two extra days to get their taxes turned in this year. While Tax Day typically falls on April 15, the IRS announced Wednesday that it is pushing back this year’s filing deadline to Tuesday, April 17. For the second year in a row, the IRS is giving taxpayers two extra days to get their taxes turned in this year. While Tax Day typically falls on April 15, the IRS announced Wednesday that it is pushing back this year’s filing deadline to Tuesday, April 17.

The extension was granted because April 15 falls on a Sunday this year, and Monday is Emancipation Day, a holiday in Washington D.C. that celebrates the freeing of slaves in the district. Last year, Tax Day was extended until April 18, also thanks to Emancipation Day.

The IRS will also begin accepting returns submitted online through the agency’s e-filing system, which the IRS says is the fastest, most accurate filing option for taxpayers, on January 17.

If you are requesting an extension, you have until Oct. 15 to file your 2011 tax return, the agency said.

The IRS said it expects to receive more than 144 million individual tax returns this year, with the majority projected to be submitted by the new April 17 deadline.

Tags: e filing, emancipation day, filing system, irs, tax return, taxpayers

Posted in CPA Rockvile |

No Comments »

|

|

If you died tomorrow, who would inherit your assets? Your house? Your Snapfish albums? If you’re like half of American adults with children, you haven’t made a will and therefore, legally speaking, haven’t answered these questions.

If you died tomorrow, who would inherit your assets? Your house? Your Snapfish albums? If you’re like half of American adults with children, you haven’t made a will and therefore, legally speaking, haven’t answered these questions.