Posts Tagged ‘taxpayers’

Posted on: January 5th, 2012 by Amy Bolger

For the second year in a row, the IRS is giving taxpayers two extra days to get their taxes turned in this year. While Tax Day typically falls on April 15, the IRS announced Wednesday that it is pushing back this year’s filing deadline to Tuesday, April 17. For the second year in a row, the IRS is giving taxpayers two extra days to get their taxes turned in this year. While Tax Day typically falls on April 15, the IRS announced Wednesday that it is pushing back this year’s filing deadline to Tuesday, April 17.

The extension was granted because April 15 falls on a Sunday this year, and Monday is Emancipation Day, a holiday in Washington D.C. that celebrates the freeing of slaves in the district. Last year, Tax Day was extended until April 18, also thanks to Emancipation Day.

The IRS will also begin accepting returns submitted online through the agency’s e-filing system, which the IRS says is the fastest, most accurate filing option for taxpayers, on January 17.

If you are requesting an extension, you have until Oct. 15 to file your 2011 tax return, the agency said.

The IRS said it expects to receive more than 144 million individual tax returns this year, with the majority projected to be submitted by the new April 17 deadline.

Tags: e filing, emancipation day, filing system, irs, tax return, taxpayers

Posted in CPA Rockvile |

No Comments »

Posted on: January 5th, 2011 by Amy Bolger

It seems we will all get three extra days to file our taxes this year. They’ll be due on Mon., April 18. Why is this you may ask – It’s not that pesky processing delay the IRS keeps telling us about. Instead, the extra days are as a result of Emancipation Day. It is a little-known Washington, DC holiday that celebrates the freeing of slaves in the District. It seems we will all get three extra days to file our taxes this year. They’ll be due on Mon., April 18. Why is this you may ask – It’s not that pesky processing delay the IRS keeps telling us about. Instead, the extra days are as a result of Emancipation Day. It is a little-known Washington, DC holiday that celebrates the freeing of slaves in the District.

The holiday actually falls on Saturday, April 16, but it is observed in D.C. on Friday, April 15. That prompted the IRS to extend the tax filing deadline to April 18 this year. Under the tax code, filing deadlines can’t fall on Saturdays, Sundays, or holidays. The last time an extension was granted for this reason was in 2007.

This won’t have much effect on the processing delay though. The delay, caused by Congress waiting until late December to pass new tax policies, simply means that the 50 million taxpayers who itemize their taxes on a Schedule A form can’t file until February. However, the IRS estimates that less than 9 million taxpayers will end up being impacted by the delay, based on historical filing patterns.

Tags: emancipation day, linkedin, tax filing deadline, tax policies, taxpayers

Posted in CPA Rockvile |

No Comments »

Posted on: October 3rd, 2010 by Amy Bolger

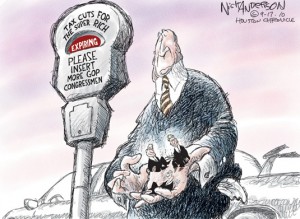

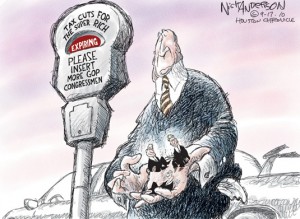

Much of the debate about whether to extend the Bush tax cuts has focused on big economic issues: how the decision might affect the fragile economy, the widening federal deficit, and hiring by small businesses. As the political battle drags on, however, it has also veered into a more basic matter of fairness, whether people who earn $200,000 a year should be taxed at rates similar to those who make $5 million. Much of the debate about whether to extend the Bush tax cuts has focused on big economic issues: how the decision might affect the fragile economy, the widening federal deficit, and hiring by small businesses. As the political battle drags on, however, it has also veered into a more basic matter of fairness, whether people who earn $200,000 a year should be taxed at rates similar to those who make $5 million.

President Obama has proposed preserving the cuts for middle-class Americans and letting them expire for the top 2.5 percent of taxpayers – individuals who make more than $200,000 a year and families whose income exceeds $250,000. But others in Congress have questioned why ending what Mr. Obama frequently calls “tax cuts for millionaires and billionaires” should also raise taxes on families making $250,000.

With the Senate unlikely to vote on the matter until after the midterm elections, some Democrats are pushing for a compromise that would leave the cuts in places for those higher up the income scale.

One proposal is called a millionaires’ tax, which would create one or two additional tax brackets for the wealthiest Americans and eliminate the Bush tax cuts only for those who earn more than seven-figure incomes. But Mr. Obama and Democratic leaders in Congress have thus far held firm to the dividing line of $200,000 for individuals and $250,000 for families. And others warn that making the tax code more complicated often has the unintended consequence of encouraging taxpayers to circumvent the system.

Most of the opposition to the plan has come from those who warn that ending the cuts, even on the wealthiest, would further weaken the struggling economy and harm small businesses. But because the cuts will expire for everyone on Jan. 1 unless Congress takes action, lawmakers are virtually certain to revisit the issue in the “lame-duck session”.

With unemployment at 9.6 percent and the economy languishing, discussions about the financial pressures facing the wealthiest Americans can quickly devolve into shouting matches.

In some expensive sections of the country, many families with income levels near the $250,000 cutoff insist that they have more in common with middle-class Americans than millionaires or billionaires. The dispute over what income level qualifies as rich is caused, in part, by the tendency of people to gauge their own wealth by comparing themselves to those closest to them.

The fact that families making $250,000 are sometimes being invoked in the same terms as billionaires is a symptom of one of the paradoxes of the American tax system: at the same time that wealth has become far more concentrated in recent decades, the tax code has become far less precise in differentiating levels of affluence.

Today’s tax code not only has far lower rates than it had a half century ago, it has fewer brackets — just six. President Obama’s plan would raise the top bracket (which affects income for individual filers who earn over $382,550) to 39.6 percent, from 35 percent. It would also raise the second-highest bracket to 36 percent, from 33 percent.

Tax brackets at the upper end of the income scale were not always drawn so broadly. In 1970, when someone earning $37,000 had the buying power of a $200,000 income today, there were 25 income brackets. The taxpayer with $37,000 was taxed at the middle of the scale; 13 of the brackets charged higher rates to those with higher income.

Congress reduced the number of brackets in the 1980s in an effort to make the tax code simpler and to cut down on the abuse of shelters and deductions. In the last 30 years, however, the percentage of total income earned by the top 1 percent of Americans has grown sharply — to 23.5 percent in 2007, from about 9 percent in 1979. And the income share of the top 0.1 percent has grown even faster — to 6 percent in 2007 from 2 percent in 1988.

But it is unclear what, if anything, Congress will do to address the issue. Republicans uniformly oppose letting any of the tax cuts expire. Democrats have vowed to pass Obama’s plan after the elections. But given that they are likely to lose seats, and possibly control of one or both houses of Congress — it is uncertain whether they will follow through, compromise or simply extend all the cuts for a limited period.

Tags: bush tax cuts, federal deficit, midterm elections, tax brackets, taxpayers

Posted in CPA Rockvile |

No Comments »

Posted on: April 14th, 2010 by Amy Bolger

If the IRS decides to target you with an audit, what would you do? Most people would just surrender, no matter how good a case they may have. Taking on the government, to most, sounds like the ultimate nightmare: costly, time consuming, and stressful. But if you are ready for the challenge, there are some smart ways to fight back. First, you should begin by hiring a smart, reputable tax preparer. Not only will they know the tax codes backwards and forwards, but they will take over the bulk of the ever-exhausting fight with the IRS. They will also help you to decide how far to take your fight. If the IRS decides to target you with an audit, what would you do? Most people would just surrender, no matter how good a case they may have. Taking on the government, to most, sounds like the ultimate nightmare: costly, time consuming, and stressful. But if you are ready for the challenge, there are some smart ways to fight back. First, you should begin by hiring a smart, reputable tax preparer. Not only will they know the tax codes backwards and forwards, but they will take over the bulk of the ever-exhausting fight with the IRS. They will also help you to decide how far to take your fight.

If you haven’t started already, make sure you save all of your tax returns forever and supporting documents for at least 3 years. The IRS only has 3 years to initiate an audit. See, Paper Records: What to Keep, What to Toss. It may seem like a nuisance, but all those papers are the most important documents for your case. The more organized and less holes you have in your documentation, the better the chance you have at winning your appeal.

If you don’t want to go to the trouble of hiring a tax specialist, you should consider taking your case to the IRS Taxpayer Advocate Service (TAS). This is an organization within the IRS that helps taxpayers resolve tax problems as well as advocate for changes within the system. You may be eligible for this service if you have tried to resolve your problems through normal IRS channels and have gotten nowhere, or if you believe an IRS procedure is not working as it should. This service is also available to those whose tax problems are causing financial hardships and they cannot afford to hire a specialist.

Most people who decide to truly have it out with the IRS file a petition with the US Tax Court. If you choose this route, you generally do not need to pay the amount in dispute while your case is pending. (This according to the court’s website: www.ustaxcourt.gov) If the tax court decides that you do owe taxes or you come to a settlement about what you will owe, the interest on those taxes runs from their original due date until paid in full, unfortunately. Your only other option is to have your case heard in Federal District Court, but the disputed amount generally needs to be paid in full and file a refund with the IRS before the case is filed.

Choosing which option is best for you ultimately is your decision, however, at least speaking with a tax specialist is always advisable. Most first time consultations are free.

Tags: audits, cpa, linkedin, tax preparer, tax returns, tax specialist, taxpayers, twitter

Posted in CPA Rockvile |

No Comments »

Posted on: April 5th, 2010 by Amy Bolger

Since 2003, taxpayers have been able to use the IRS’ “Where’s My Refund?” web page to track down refunds directly from their own computer. Exactly when you will need to use this service, however, depends on when and how you filed your return as well as how you asked to have your refund issued to you. If you e-file and ask for direct deposit, the IRS says that it should take no more than 3 weeks to receive your refund. If you paper filed your return and asked for your check to be mailed to you, it could take up to 8 weeks. Since 2003, taxpayers have been able to use the IRS’ “Where’s My Refund?” web page to track down refunds directly from their own computer. Exactly when you will need to use this service, however, depends on when and how you filed your return as well as how you asked to have your refund issued to you. If you e-file and ask for direct deposit, the IRS says that it should take no more than 3 weeks to receive your refund. If you paper filed your return and asked for your check to be mailed to you, it could take up to 8 weeks.

To get started you will need your Social Security number, the filing status entered on your return, and the exact amount you are expecting. (You can always call your CPA for the exact amount if you don’t recall) Joint return filers should enter the name and tax ID number of the spouse first shown on the return. Once you submit, the program should let you know exactly where your refund is.

If you still would prefer to make a phone call though, you can call their special automated toll-free number: (800) 829-1954. You will need the same information that the online system requires.

Tags: cpa, irs, linkedin, tax refund, taxpayers, where s my refund

Posted in CPA Rockvile |

No Comments »

Posted on: March 22nd, 2010 by Amy Bolger

CPA Rockville –  Want your tax refund faster? File your federal return online and have the refund direct deposited into your bank account. The Internal Revenue Service has promised to get refunds out to those who electronically file their taxes online in as few as 10 days. For those who choose to mail their return in, refunds are expected to take four to six weeks. Want your tax refund faster? File your federal return online and have the refund direct deposited into your bank account. The Internal Revenue Service has promised to get refunds out to those who electronically file their taxes online in as few as 10 days. For those who choose to mail their return in, refunds are expected to take four to six weeks.

For those filers taking advantage of the expanded home buyer tax credits, however, paper forms must still be filed because Congress has required documentation to claim them. Under the program, buyers who have owned their current homes at least five years would be eligible, subject to income limits, for tax credits of up to $6,500. First time home buyers or people who haven’t owned homes in the previous three years could receive up to $8,000.

Taxpayers can file their returns electronically whether they use a paid tax preparer/CPA in Rockville, Maryland or do it themselves. For families and individuals making less than $57,000, the IRS offers Free File computer software programs that help taxpayers prepare their returns at no charge. Those making more than $57,000 can still file their returns online at no cost, they just won’t get the additional free help.

Tags: cpa, first time homebuyers, tax preparer, tax refund, taxpayers

Posted in CPA Rockvile |

No Comments »

|

|

For the second year in a row, the IRS is giving taxpayers two extra days to get their taxes turned in this year. While Tax Day typically falls on April 15, the IRS announced Wednesday that it is pushing back this year’s filing deadline to Tuesday, April 17.

For the second year in a row, the IRS is giving taxpayers two extra days to get their taxes turned in this year. While Tax Day typically falls on April 15, the IRS announced Wednesday that it is pushing back this year’s filing deadline to Tuesday, April 17.