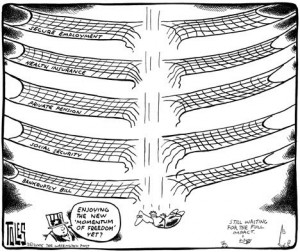

Who really benefits from the “Safety Net”

Posted on: February 15th, 2012 by Amy BolgerA new analysis from the Center on Budget and Policy Priorities underscores that the poor are no longer the primary beneficiaries of the government safety net. Terms like entitlements, government benefits, and safety net often conjure images of tax dollars sliding from the hands of the wealthy into the pockets of the poor. But as reported by The New York Times, Saturday, that image is badly outdated. Benefits are now flow primarily to the middle class.

The center’s study found that the poorest American households, the bottom fifth, received just 32 cents of every dollar of government benefits distributed in 2010. The finding is broadly consistent with the data reported Sunday that the poorest households received 36 percent of benefits in 2007, down from 54 percent in 1979, numbers that came from a study published last year by the Congressional Budget Office.

While the findings are not directly comparable because of differences in methodology, the new study suggests that the recent recession did not cause any significant increase in the share of benefits flowing to the poor, as might once have been expected. The study found that older people received slightly more than half of government benefits, while the non-elderly with disabilities received an additional 20 percent. These benefits are not means tested, but rather, better-paid workers get more in Social Security.

Furthermore, the study notes that politicians have shifted benefits away from the “jobless poor,” through reductions in traditional welfare, and increased benefits for working families, for example through tax credits. The government also also expanded elegibility for benefit programs.

“The safety net became much more work-based,” wrote Arloc Sherman and his collaborators at the center, a left-leaning research group. “In addition, the U.S. population is aging, which raises the share of benefits going to seniors and people with disabilities.”

Another finding of the study is that the distribution of benefits no longer aligns with the demography of poverty. African-Americans, who make up 22 percent of the poor, receive 14 percent of government benefits, close to their 12 percent population share. White non-Hispanics, who make up 42 percent of the poor, receive 69 percent of government benefits… again, much closer to their 64 percent population share.