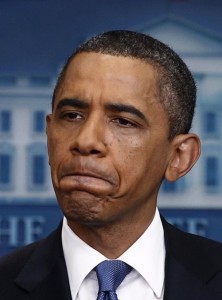

How to fix the glitch in Obama’s health law

Posted on: July 19th, 2011 by Amy Bolger On Monday, Republican Sen. Mike Enzi of Wyoming introduced legislation to fix a glitch that would have allowed some middle-class early retirees to get health insurance at virtually no cost by qualifying for Medicaid coverage meant for the poor. Democratic Sen. Ben Nelson of Nebraska introduced a similar bill, signaling the fix could have bipartisan support.

On Monday, Republican Sen. Mike Enzi of Wyoming introduced legislation to fix a glitch that would have allowed some middle-class early retirees to get health insurance at virtually no cost by qualifying for Medicaid coverage meant for the poor. Democratic Sen. Ben Nelson of Nebraska introduced a similar bill, signaling the fix could have bipartisan support.

The problem surfaced very recently. The mix-up would have created unintended consequences for tax credits that Obama’s law provides to make private health insurance more affordable for people who purchase coverage individually. An early retiree drawing Social Security would have paid much less for the same policy than someone of the same age, similar medical history, earning the same total income from work. Tax credits and a Medicaid expansion are part of the law’s big push to cover the uninsured, which starts in 2014.

Health and Human Services spokeswoman Erin Shields welcomed Enzi’s involvement. “We look forward to studying his proposal,” she said. “The administration is exploring options for a fix.”

The Associated Press first reported the problem last month, after Medicare Chief Actuary Richard Foster raised concerns and said he was having trouble getting policymakers interested. The nonpartisan actuary’s office conducts long-range cost estimates for government health care programs. “I try to stay out of policy issues, but this is one where I think a change is in order,” Foster told the House Budget Committee last week. Earlier, he simply said the glitch “just doesn’t make sense.”

Enzi’s legislation would reverse the health care law, requiring Social Security income to be counted as income when determining eligibility for Medicaid and for tax credits to purchase private insurance. In a memo provided by the senator’s office, the nonpartisan Congressional Budget Office estimated the legislation would reduce the deficit by about $13 billion between 2014 and 2021, without raising the number of uninsured people.

“The change in the income definition is estimated to have a negligible effect on the number of individuals who are uninsured,” said the CBO memo. People would still be able to get coverage, they just wouldn’t be getting it free or as heavily discounted. The fix would affect about 500,000 to 1 million people a year, a smaller number than the 3 million Foster’s office had estimated.