Posted on: January 7th, 2015 by Amy Bolger

Check Refund Status

Check Refund Status

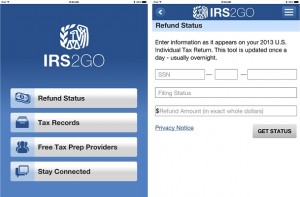

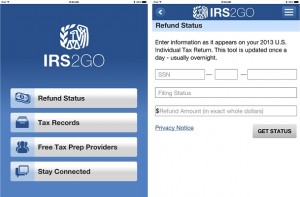

You can check the status of your federal income tax refund using IRS2Go. Simply enter your Social Security number, which will be masked and encrypted for security purposes, then select your filing status and enter the amount of your anticipated refund from your 2013 tax return. A status tracker has been added so you can see where your tax return is in the process. If you filed your return electronically, you can check your refund status within a 24 hours after we receive your return. If you file a paper tax return, you will need to wait about four weeks to check your refund status because it takes longer to process a paper return.

Tax Records

You can request your tax return or account transcript using your smartphone. IRS2Go allows you to request this information, which will be mailed to you within several business days.

Free Tax Prep Providers

The IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) Programs offer free tax help for taxpayers who qualify. You can use this brand new tool to help you find a VITA site right near your home. You simply enter your zip code and select a mileage range. To make it even more convenient if you click on the directions button within the results the maps application on your device will load with the address, making it easy to navigate to your desired location.

Stay Connected

You can interact with the IRS by following us on Twitter, watching helpful videos on YouTube, sign up for email updates, or contact us.

Download the IRS2Go App

If you have an Apple iPhone or iTouch, you can download the free IRS2Go app by visiting the iTunes app store. If you have an Android device, you can visit Google Play to download the free IRS2Go app.

Posted on: October 27th, 2010 by Amy Bolger

For many Americans, an income tax refund is a windfall. But the amount of this refund is determined by the numbers that are generated from the previous year. Therefore, the fourth quarter of the year is the time to start thinking about what can be done to maximize the amount that you can get back when you file your return in the spring. Here are s few tips to help out as the year draws to a close:

For many Americans, an income tax refund is a windfall. But the amount of this refund is determined by the numbers that are generated from the previous year. Therefore, the fourth quarter of the year is the time to start thinking about what can be done to maximize the amount that you can get back when you file your return in the spring. Here are s few tips to help out as the year draws to a close:

1.) Charitable Donations: Filers who are on the edge of being able to itemize their deductions for the year should consider making a donation of either cash or property to a qualified charity before the year is out. This can be especially beneficial if the filer has a piece of property of some value that he or she wishes to dispose of, such as an extra car or recreational vehicle.

2.) Retirement Plan Contributions: Those who need to reduce their taxable income for the year should make the maximum allowable contributions to their traditional, deductible retirement plans. In some cases, such as small business owners and those who make the maximum allowable lump-sum contribution to their plans for the year, this deduction can be fairly large. Although contributing to Roth accounts may be the best way to go for some, traditional plan contributions afford a current deduction that can make a huge difference in the amount of declarable income for many filers. Even low-income taxpayers can claim the retirement savers’ credit for small contributions to their IRAs or employer-sponsored qualified plans.

3.) Organization: As basic as this sounds, good record keeping is essential to maximizing your tax deductions. Make sure that you record every charitable contribution, every above-the-line deduction and anything else that can increase your income tax refund for the year. Keep copies of all receipts and other documentation that proves your transactions, as the IRS now requires this in order to accept these deductions on every return.

4.) Miscellaneous Deductions: Many taxpayers may be surprised when they discover that certain kinds of expenses or losses can be deducted on their tax returns. Ask your tax preparer what sorts of losses you can deduct.

5.) Capital Losses: This could be a good time to cut your losses in the market, if you are a short-term investor. Swap out losing stocks or bonds for similar holdings that offer potential gains and realize the losses on your return.

Check Refund Status

Check Refund Status