What is the Definition of Rich

Posted on: October 3rd, 2010 by Amy Bolger Much of the debate about whether to extend the Bush tax cuts has focused on big economic issues: how the decision might affect the fragile economy, the widening federal deficit, and hiring by small businesses. As the political battle drags on, however, it has also veered into a more basic matter of fairness, whether people who earn $200,000 a year should be taxed at rates similar to those who make $5 million.

Much of the debate about whether to extend the Bush tax cuts has focused on big economic issues: how the decision might affect the fragile economy, the widening federal deficit, and hiring by small businesses. As the political battle drags on, however, it has also veered into a more basic matter of fairness, whether people who earn $200,000 a year should be taxed at rates similar to those who make $5 million.

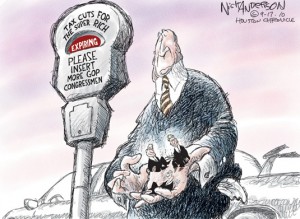

President Obama has proposed preserving the cuts for middle-class Americans and letting them expire for the top 2.5 percent of taxpayers – individuals who make more than $200,000 a year and families whose income exceeds $250,000. But others in Congress have questioned why ending what Mr. Obama frequently calls “tax cuts for millionaires and billionaires” should also raise taxes on families making $250,000.

With the Senate unlikely to vote on the matter until after the midterm elections, some Democrats are pushing for a compromise that would leave the cuts in places for those higher up the income scale.

One proposal is called a millionaires’ tax, which would create one or two additional tax brackets for the wealthiest Americans and eliminate the Bush tax cuts only for those who earn more than seven-figure incomes. But Mr. Obama and Democratic leaders in Congress have thus far held firm to the dividing line of $200,000 for individuals and $250,000 for families. And others warn that making the tax code more complicated often has the unintended consequence of encouraging taxpayers to circumvent the system.

Most of the opposition to the plan has come from those who warn that ending the cuts, even on the wealthiest, would further weaken the struggling economy and harm small businesses. But because the cuts will expire for everyone on Jan. 1 unless Congress takes action, lawmakers are virtually certain to revisit the issue in the “lame-duck session”.

With unemployment at 9.6 percent and the economy languishing, discussions about the financial pressures facing the wealthiest Americans can quickly devolve into shouting matches.

In some expensive sections of the country, many families with income levels near the $250,000 cutoff insist that they have more in common with middle-class Americans than millionaires or billionaires. The dispute over what income level qualifies as rich is caused, in part, by the tendency of people to gauge their own wealth by comparing themselves to those closest to them.

The fact that families making $250,000 are sometimes being invoked in the same terms as billionaires is a symptom of one of the paradoxes of the American tax system: at the same time that wealth has become far more concentrated in recent decades, the tax code has become far less precise in differentiating levels of affluence.

Today’s tax code not only has far lower rates than it had a half century ago, it has fewer brackets — just six. President Obama’s plan would raise the top bracket (which affects income for individual filers who earn over $382,550) to 39.6 percent, from 35 percent. It would also raise the second-highest bracket to 36 percent, from 33 percent.

Tax brackets at the upper end of the income scale were not always drawn so broadly. In 1970, when someone earning $37,000 had the buying power of a $200,000 income today, there were 25 income brackets. The taxpayer with $37,000 was taxed at the middle of the scale; 13 of the brackets charged higher rates to those with higher income.

Congress reduced the number of brackets in the 1980s in an effort to make the tax code simpler and to cut down on the abuse of shelters and deductions. In the last 30 years, however, the percentage of total income earned by the top 1 percent of Americans has grown sharply — to 23.5 percent in 2007, from about 9 percent in 1979. And the income share of the top 0.1 percent has grown even faster — to 6 percent in 2007 from 2 percent in 1988.

But it is unclear what, if anything, Congress will do to address the issue. Republicans uniformly oppose letting any of the tax cuts expire. Democrats have vowed to pass Obama’s plan after the elections. But given that they are likely to lose seats, and possibly control of one or both houses of Congress — it is uncertain whether they will follow through, compromise or simply extend all the cuts for a limited period.