Posts Tagged ‘tax returns’

Posted on: March 14th, 2013 by Amy Bolger

A tax-preparation software glitch caused more than 600,000 returns to be filed incorrectly, delaying refunds by as much as six weeks, the IRS says. A tax-preparation software glitch caused more than 600,000 returns to be filed incorrectly, delaying refunds by as much as six weeks, the IRS says.

H&R Block, the nation’s largest tax preparer, confirmed that its software failed to fill out a mandatory field on Form 8863, which is used to claim educational credits. The IRS would not say what percentage of the roughly 600,000 faulty returns came from H&R Block, but the company received thousands of complaints on its Facebook page and on Twitter. An Internet search did not yield similar complaints against other tax preparers.

The snafu is affecting about 10% of the 6.6 million tax returns containing Form 8863, IRS spokeswoman Michelle Eldridge says. Those taxpayers may have to wait six more weeks before they receive their refunds, she says, adding that the IRS is hoping to reduce that wait time.

H&R Block confirms there is an issue with tax returns filed before Feb. 22 because the IRS changed the way it processes some of the yes or no questions on the form. While in previous years, leaving a field blank to indicate “No” on certain questions was acceptable, the IRS is now requiring preparers to enter an “N.” As a result, H&R Block says, it is working with the IRS to clear these errors, but the company would not give details on how it is correcting returns or exactly how long taxpayers will have to wait for their refunds. The IRS says it is able to keep processing these returns now that it is aware of the system-wide error, but that affected taxpayers will still face delays because of extra steps needed to correct the issue.

The error is creating delays for taxpayers who, following the fiscal-cliff deal, already had to wait an extra two weeks before filing their returns, many of whom were counting on their refunds to pay their bills.

Leslee Napier, a 26-year old nursing student in Princeton, Ind., prepared her return with H&R Block on Jan. 24 so that it would be one of the first returns accepted on Feb. 14, when the IRS began processing forms for education credits. But weeks after her return was supposed to be accepted, the “Where’s My Refund” tool on IRS.gov said her return was still being processed. It wasn’t until more than three weeks after her return was supposed to be accepted that an IRS agent told Napier her return was being held because of issues with Form 8863 and that it might be four more weeks before she receives her refund. “I was worried all this time that I did something wrong or that I was being audited,” says Napier, who is waiting on her refund to pay off a $600 line of credit she opened with H&R Block in December to get her through the holidays. Meanwhile, interest charges are piling up, she says, and she is waiting to catch up on bills and buy new clothes for her 2-year-old daughter.

For students, the delays come at a time when many are facing state deadlines for applying for financial aid: the Free Application for Federal Student Aid, the form for applying for federal financial aid, requires tax information. Elizabeth Havens, a student in South Carolina, says she took a copy of her return to her school so that she could move ahead with her financial aid application while she waits for IRS approval.

Students still waiting on their returns to be processed can manually enter their financial data on the FAFSA and then return to update the information once their returns have been accepted, according to the IRS.

Maybe you should look for a BETTER tax professional.

Tags: educational credits, form 8863 irs, linkedin, tax preparation software, tax preparer, tax preparers, tax returns

Posted in CPA Rockvile |

No Comments »

Posted on: September 29th, 2010 by Amy Bolger

Electronic filing of tax returns has become so popular that the Internal Revenue Service will no longer automatically mail a traditional paper form. “We’re finding that more and more people are choosing to e-file, and the number of paper returns is going down,” said IRS spokesman Anthony Burke. He told CNN Tuesday that the agency last year mailed the old-style set of paper forms, tables and instructions to just eight percent of the nation’s taxpayers. Burke said 96 million taxpayers this year have filed electronically, with another 20 million filing through professional tax preparers. The IRS hopes to save $10 million a year by not automatically mailing the materials. Electronic filing of tax returns has become so popular that the Internal Revenue Service will no longer automatically mail a traditional paper form. “We’re finding that more and more people are choosing to e-file, and the number of paper returns is going down,” said IRS spokesman Anthony Burke. He told CNN Tuesday that the agency last year mailed the old-style set of paper forms, tables and instructions to just eight percent of the nation’s taxpayers. Burke said 96 million taxpayers this year have filed electronically, with another 20 million filing through professional tax preparers. The IRS hopes to save $10 million a year by not automatically mailing the materials.

Those who prefer hardcopy documents can still find them at libraries, post offices and walk-in IRS offices around the country. After Jan. 1, they can request a mailing through the IRS toll-free number, 800-829-3676. The materials will also be available to download and print out from the IRS website: www.irs.gov.

Some people may not miss the annual ritual of opening their mailbox and finding the dreaded reminder of tax time. Burke said the IRS “won’t produce the package any more,” as the agency transitions to providing software and other support for electronic filing. Instead, in the next few weeks, those who filed traditional paperwork last year will get a simple postcard from the IRS, with instructions on how to obtain the documents needed to file a tax return.

Tags: irs website, linkedin, professional tax preparers, tax forms, tax returns, tax time

Posted in CPA Rockvile |

No Comments »

Posted on: April 14th, 2010 by Amy Bolger

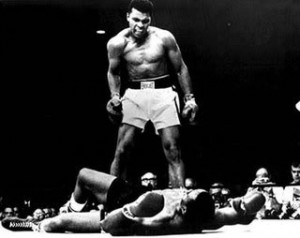

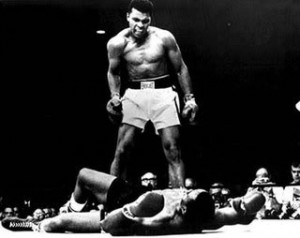

If the IRS decides to target you with an audit, what would you do? Most people would just surrender, no matter how good a case they may have. Taking on the government, to most, sounds like the ultimate nightmare: costly, time consuming, and stressful. But if you are ready for the challenge, there are some smart ways to fight back. First, you should begin by hiring a smart, reputable tax preparer. Not only will they know the tax codes backwards and forwards, but they will take over the bulk of the ever-exhausting fight with the IRS. They will also help you to decide how far to take your fight. If the IRS decides to target you with an audit, what would you do? Most people would just surrender, no matter how good a case they may have. Taking on the government, to most, sounds like the ultimate nightmare: costly, time consuming, and stressful. But if you are ready for the challenge, there are some smart ways to fight back. First, you should begin by hiring a smart, reputable tax preparer. Not only will they know the tax codes backwards and forwards, but they will take over the bulk of the ever-exhausting fight with the IRS. They will also help you to decide how far to take your fight.

If you haven’t started already, make sure you save all of your tax returns forever and supporting documents for at least 3 years. The IRS only has 3 years to initiate an audit. See, Paper Records: What to Keep, What to Toss. It may seem like a nuisance, but all those papers are the most important documents for your case. The more organized and less holes you have in your documentation, the better the chance you have at winning your appeal.

If you don’t want to go to the trouble of hiring a tax specialist, you should consider taking your case to the IRS Taxpayer Advocate Service (TAS). This is an organization within the IRS that helps taxpayers resolve tax problems as well as advocate for changes within the system. You may be eligible for this service if you have tried to resolve your problems through normal IRS channels and have gotten nowhere, or if you believe an IRS procedure is not working as it should. This service is also available to those whose tax problems are causing financial hardships and they cannot afford to hire a specialist.

Most people who decide to truly have it out with the IRS file a petition with the US Tax Court. If you choose this route, you generally do not need to pay the amount in dispute while your case is pending. (This according to the court’s website: www.ustaxcourt.gov) If the tax court decides that you do owe taxes or you come to a settlement about what you will owe, the interest on those taxes runs from their original due date until paid in full, unfortunately. Your only other option is to have your case heard in Federal District Court, but the disputed amount generally needs to be paid in full and file a refund with the IRS before the case is filed.

Choosing which option is best for you ultimately is your decision, however, at least speaking with a tax specialist is always advisable. Most first time consultations are free.

Tags: audits, cpa, linkedin, tax preparer, tax returns, tax specialist, taxpayers, twitter

Posted in CPA Rockvile |

No Comments »

Posted on: March 12th, 2010 by Amy Bolger

CPA Rockville – A large number of individuals hire the services of a CPA all year round to ensure that their finances are in order. Although most accountants are hired on a long-term basis, there are a few accountants that are only hired to professionally prepare tax returns.

Many individuals or business owners are often encouraged to seek a local accountant for the sole reason that should a problem/situation arise, it is more convenient to resolve. But since accountants are often versed in the tax laws of multiple states, it is not always a bad idea to seek out the accountant with the best reputation, most experience, and most personal service. Personal service is very important because you know that the person you have hired is looking out for your best interest. Even though a firm may be local, you may not even know who is performing the service to you.

So the answer is quite simple: Because it is an easy way to have your financial records in order or your tax returns professionally completed. The job of the CPA is to know how to get their clients the maximum number of tax deductions and know how to accurately organize receipts and other document verifications for those tax deductions. So, instead of spending hours reviewing and sorting through your finances, you should contact a CPA firm in Rockville and get a consultation to determine if hiring an accountant is the right move for you.

Tags: accountant, accountants, cpa firm, reputation, tax returns

Posted in CPA Rockvile |

No Comments »

|

|

A tax-preparation software glitch caused more than 600,000 returns to be filed incorrectly, delaying refunds by as much as six weeks, the IRS says.

A tax-preparation software glitch caused more than 600,000 returns to be filed incorrectly, delaying refunds by as much as six weeks, the IRS says.