Posts Tagged ‘tax return’

Posted on: January 7th, 2015 by Amy Bolger

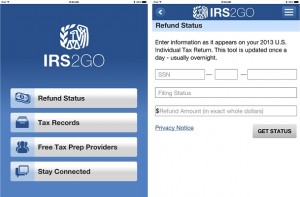

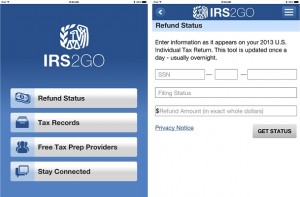

Check Refund Status Check Refund Status

You can check the status of your federal income tax refund using IRS2Go. Simply enter your Social Security number, which will be masked and encrypted for security purposes, then select your filing status and enter the amount of your anticipated refund from your 2013 tax return. A status tracker has been added so you can see where your tax return is in the process. If you filed your return electronically, you can check your refund status within a 24 hours after we receive your return. If you file a paper tax return, you will need to wait about four weeks to check your refund status because it takes longer to process a paper return.

Tax Records

You can request your tax return or account transcript using your smartphone. IRS2Go allows you to request this information, which will be mailed to you within several business days.

Free Tax Prep Providers

The IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) Programs offer free tax help for taxpayers who qualify. You can use this brand new tool to help you find a VITA site right near your home. You simply enter your zip code and select a mileage range. To make it even more convenient if you click on the directions button within the results the maps application on your device will load with the address, making it easy to navigate to your desired location.

Stay Connected

You can interact with the IRS by following us on Twitter, watching helpful videos on YouTube, sign up for email updates, or contact us.

Download the IRS2Go App

If you have an Apple iPhone or iTouch, you can download the free IRS2Go app by visiting the iTunes app store. If you have an Android device, you can visit Google Play to download the free IRS2Go app.

Tags: apple iphone, check refund status, federal income tax, federal income tax refund, free tax help, google, income tax refund, social security number, tax return

Posted in CPA Rockvile, Latest News |

No Comments »

Posted on: February 15th, 2012 by Amy Bolger

WHEN confronted by a letter from the Internal Revenue Service, some people look at is as though they’ve seen a ghost. BOO! WHEN confronted by a letter from the Internal Revenue Service, some people look at is as though they’ve seen a ghost. BOO!

And when they open certain letters, a few people do see a ghost — or, more accurately, the ghost of a tax return.

When the IRS detects that a person had reportable income but did not file a return, even after much cajoling, it steps in and does the job itself. Based on what it knows, the agency prepares what it calls a “substitute for return”, a Form 1040 (the generic tax return). It lists income, calculates the tax due, adds interest and a penalty for failing to file, and sends the recalcitrant taxpayer a bill based on its efforts.

In one way, that may be a relief to procrastinators who just didn’t get around to filing, perhaps for years. But it often comes at a VERY high price.

Substitute returns are really no substitute for ones that taxpayers could have filed themselves. That’s because the IRS uses data from only the income side when it creates such a return, which means that it doesn’t include all kinds of items that might offset that income, according to Julian Block, a tax lawyer in Larchmont, N.Y.

The IRS works from W-2 reports of wages paid, filed by employers, and reports of payments to self-employed people from companies that used their services. The agency also uses reports from financial institutions about interest and dividends paid and reports from brokers about assets sold. All these things are taxable income.

For self-employed people, in particular, there is often a big disparity between payments received and taxable income, because much of what they receive goes for supplies or salaries or other expenses. But the IRS will know only the gross payment, and will plug that figure into its return. It does not even know about the original cost of assets that were reported sold.

In other words, the IRS does not include many of the deductions to which a non-filer may be entitled. But this doesn’t mean that the IRS is being mean or vengeful or evil.

The IRS is candid that it does not even look for deductions. In a fact sheet in what it calls the “tax gap” series on its Web site, the IRS warns that a substitute return it prepares is a “basic” one that “will not include any of your additional exemptions or expenses.”

The IRS investigates about a million “non-filer situations” a year. But it does not prepare a substitute return for everyone that it believes failed to file. People in the underground economy do not leave a trail that can contribute to such a return, tax experts have been noted as saying. If those people are caught, they may not get an official printout in the mail. A visit from someone who dangles handcuffs from a belt is more likely. And the IRS substitute is not used when a taxpayer has filed a return but the agency believes that he or she failed to report some income. It has other methods for resolving those issues — often an audit… just what we all have time for!

A taxpayer prompted to action by a substitute return can file the return that he or she should have filed in the first place, and the IRS will adjust the taxpayer’s account accordingly. The next step, in which taxpayers can claim their exemptions and deductions, can sharply cut the amount due or even yield a refund. Many nonfilers wouldn’t owe large amounts if their returns were done properly. The IRS fact sheet says its research shows that such failures “could simply be due to procrastination”, as stated by Mr. Eric Bach, CPA.

ONCE a ghost return appears in the mail, simply avoiding it isn’t a viable option. The IRS will send reminders. If there is no response, it will start collection efforts, based on its calculations.

“The worst thing a taxpayer can do, is not file a return and then continue to ignore the repeated letters from the IRS”, Mr. Bach said.

But taxpayers sometimes do just that, provoked by “fear, paralysis, and denial”, as Mr. Bach has stated it. “The most important point to remember is that the substitute returns only reflect the income and some some expense information such as mortgage interest because they are required to be reported to the IRS. These returns are not final. When the actual return is filed, it supercedes the ‘ghost return’. This is very important to remember because the actual return will include your itemized deductions that may substantially reduce the IRS’ original assessment.” In essence, Mr. Bach’s point is, file your returns as quickly as possible if a “ghost return” has been filed to, not only reduce your tax debt and possibly eliminate it, but also to minimize penalties.

Unpleasant as it may be to file a tax return, and paying the bill to begin with… filing may prove much more appealing than the alternatives.

Tags: ghost return, internal revenue service, irs, linkedin, tax lawyer, tax return, taxable income

Posted in CPA Rockvile |

No Comments »

Posted on: February 8th, 2012 by Amy Bolger

Eric L. Bach & Associates – Yes, filing your taxes can be trying and extremely annoying… therefor we like to put the whole ordeal off until the last possible moment. Other than getting your refund sooner or having more time to gather up the funds to pay your tax bill, there is another good reason to get your taxes done early: identity theft. Simply, this is when someone gets your Social Security number or other identifying information and forges a tax return in your name to get a refund. Eric L. Bach & Associates – Yes, filing your taxes can be trying and extremely annoying… therefor we like to put the whole ordeal off until the last possible moment. Other than getting your refund sooner or having more time to gather up the funds to pay your tax bill, there is another good reason to get your taxes done early: identity theft. Simply, this is when someone gets your Social Security number or other identifying information and forges a tax return in your name to get a refund.

It’s understandable that many people don’t want to deal with the IRS because it can be a very trying experience. But, just imagine how frustrated you would be if you found out someone had filed a false tax return using information stolen from you. Identity thieves will often submit their fake returns early in the filing season before the victim finishes their real return.

Tax refund identity theft is a growing problem. In 2010, the IRS was able to identify and remove almost 49,000 returns seeking fraudulent refunds. Last year, it removed 262,000 fraudulent returns. The IRS is taking every step they can to try to combat this problem. If you suspect you are a victim of identity theft, contact the IRS Identity Protection Specialized Unit at 800-908-4490. You will then be asked to complete IRS Form 14039, the identity-theft affidavit. Also, remember that the IRS will not contact you by email to request any personal or financial information. If you get any such message, delete immediately. Do not, however, dismiss IRS notices you receive in the mail that indicate that more than one tax return was filed for you.

Tags: fraudulent returns, irs notices, linkedin, social security, tax refund, tax return, victim of identity theft

Posted in CPA Rockvile |

No Comments »

Posted on: January 5th, 2012 by Amy Bolger

For the second year in a row, the IRS is giving taxpayers two extra days to get their taxes turned in this year. While Tax Day typically falls on April 15, the IRS announced Wednesday that it is pushing back this year’s filing deadline to Tuesday, April 17. For the second year in a row, the IRS is giving taxpayers two extra days to get their taxes turned in this year. While Tax Day typically falls on April 15, the IRS announced Wednesday that it is pushing back this year’s filing deadline to Tuesday, April 17.

The extension was granted because April 15 falls on a Sunday this year, and Monday is Emancipation Day, a holiday in Washington D.C. that celebrates the freeing of slaves in the district. Last year, Tax Day was extended until April 18, also thanks to Emancipation Day.

The IRS will also begin accepting returns submitted online through the agency’s e-filing system, which the IRS says is the fastest, most accurate filing option for taxpayers, on January 17.

If you are requesting an extension, you have until Oct. 15 to file your 2011 tax return, the agency said.

The IRS said it expects to receive more than 144 million individual tax returns this year, with the majority projected to be submitted by the new April 17 deadline.

Tags: e filing, emancipation day, filing system, irs, tax return, taxpayers

Posted in CPA Rockvile |

No Comments »

Posted on: October 4th, 2010 by Amy Bolger

You might think that the beginning of October is a bit early to start worrying about taking care of year-end business. But with these three must-dos, getting an early start doesn’t just let you cross a chore off your list, it can actually put some extra money in your pocket. You might think that the beginning of October is a bit early to start worrying about taking care of year-end business. But with these three must-dos, getting an early start doesn’t just let you cross a chore off your list, it can actually put some extra money in your pocket.

1. Make the most of your retirement accounts.

Retirement savers have a lot to keep in mind at year-end. Although you don’t have to make current-year contributions to IRAs until next April 15, there’s a laundry list of other tasks you have to take care of before December ends:

- Contributions to 401(k)s and other employer-sponsored retirement plans are due by Dec. 31.

- If you’re required to take mandatory distributions from your retirement accounts, either because you’re age 70 1/2 or older or because you have an inherited IRA, then you must do so by the end of the year.

- The opportunity to convert your traditional IRA to a Roth and take advantage of special 2010 rules that allow you to put off the tax impact until 2011 and 2012 goes away on Jan. 1.

These things are easy to forget about in the year-end rush. There are big penalties for not taking required minimum distributions, but even more costly is the opportunity cost of not getting as much money as you can into your retirement accounts.

2. Taking tax losses.

If you’ve lost money on a stock, you can get a tax break by taking a capital loss on your tax return. To do so, though, you must sell the stock by Dec. 31. The reason you might want to do so early, though, is to get a jump on everyone else doing the same thing. Another advantage is that if you want to take losses but still own the stock in the future, you have to wait 30 days after selling to buy it back. If you sell now, you can buy back in November or December, just as latecomers are selling, hopefully pushing the price down to let you get in more cheaply.

3. Re-balance your portfolio.

If you haven’t done re-balancing in a while, you shouldn’t put it off any longer. Whether it’s getting your stock/bond mix back to normal or adjusting your sector exposure, re-balancing makes sure you’re taking the right amount of risk.

For instance, say you have allocations to both financial stocks and real-estate investment trusts. If you haven’t rebalanced, the value of your REITs is much higher than your financials, leaving you overly exposed if REITs reverse course and fall. By re-balancing, you lock in some profits on your REITs while taking advantage of low prices to boost your financial exposure. It’s not guaranteed to make you money, but over time, rebalancing has helped many people take advantage of the natural cycles within markets.

SO……. Do it today

Sure, you could wait on some of these things. But why wait? There is no time like the present. By acting sooner than later, you can get a jump on your peers; and being first out of the gate may well mean more money in your pocket.

Tags: retirement accounts, tax break, tax impact, tax losses, tax return, traditional ira

Posted in CPA Rockvile, Financial Planning Rockville |

No Comments »

Posted on: April 19th, 2010 by Amy Bolger

Half of Americans don’t have a retirement plan through their employer, and those that do, few are saving enough to finance a retirement that will last several decades. To encourage more workers to plan for the future, federal initiatives were established to make saving easier. Often, when employees are left to their own devices, they fail to sign up for their company’s 401(k) plan. To get more workers to save though, many large companies now automatically enroll their employees unless the worker takes the initiative to opt out. A new rule also makes it easier for smaller companies to automatically sign up their employees and increase their amount of savings each year. Half of Americans don’t have a retirement plan through their employer, and those that do, few are saving enough to finance a retirement that will last several decades. To encourage more workers to plan for the future, federal initiatives were established to make saving easier. Often, when employees are left to their own devices, they fail to sign up for their company’s 401(k) plan. To get more workers to save though, many large companies now automatically enroll their employees unless the worker takes the initiative to opt out. A new rule also makes it easier for smaller companies to automatically sign up their employees and increase their amount of savings each year.

Another easy way to save is to convert your unused sick & vacation days into your 401(k). The new federal initiative allows workers to roll over their unused days into their retirement account. Although many workers have not taken advantage of this, it can pay off tremendously in the long run. One theory is that, on average, US workers only receive about 15 paid days off per year and people value these days tremendously. They may not use them all within the year, but employees tend to hold these days very close and are not willing to convert/roll them over.

Finally, especially for those that have filed extensions on their tax returns, you can have a portion of your tax return directly deposited into an IRA OR you can easily purchase Series I Savings Bonds simply by checking a box on your return. Additionally, next year, it will become available to add co-owners to the bonds, such as children. You can speak to your tax preparer about how to go about doing this.

Tags: 401 k, federal initiative, retirement account, tax preparer, tax return

Posted in CPA Rockvile |

No Comments »

Posted on: April 15th, 2010 by Amy Bolger

Whether you completed your return months ago or are just getting it in at 11:59pm on April 15, you are still relieved to have your return in Uncle Sam’s hands on time. But before you file away your 1040 for good, make a copy of it for your financial adviser. Some careful scanning of this document can help you plan for the future. And that doesn’t just mean adjusting your withholdings or estimated payments or catching missed deductions; it can be a valuable tool to help you determine the best usage of your money, what types of investments might work best for you, and what types of portfolio changes you may want to make. Whether you completed your return months ago or are just getting it in at 11:59pm on April 15, you are still relieved to have your return in Uncle Sam’s hands on time. But before you file away your 1040 for good, make a copy of it for your financial adviser. Some careful scanning of this document can help you plan for the future. And that doesn’t just mean adjusting your withholdings or estimated payments or catching missed deductions; it can be a valuable tool to help you determine the best usage of your money, what types of investments might work best for you, and what types of portfolio changes you may want to make.

One thing to look for on your return is if you have more than $1000 in taxable interest or unqualified dividends, you may want to think about relocating some of those holdings into tax deferred accounts. Another option, if you need to keep those funds readily available, is to look into a stock index fund that covers the total US or international markets. These funds don’t trade holdings often, so they don’t generate many capital gains. You should discuss the tax implications of these funds with your tax adviser first, as the rates are soon to be changing.

You should also look for capital losses that you are able to carry forward to future years. You can use your capital losses to offset your capital gains, so you may be able to make some investment changes without incurring a tax bill. Talking with your financial adviser about your portfolio may help you to determine if you have some investments you want to sell to re-balance the taxable portion of your portfolio or get rid of some high fee mutual funds. But, you shouldn’t just make the changes just for the sake of using up the losses because you can use $3000 each year to reduce your taxable income.

Tags: capital gains, financial adviser, investments, linkedin, tax adviser, tax return

Posted in CPA Rockvile |

No Comments »

Posted on: April 12th, 2010 by Amy Bolger

There are a few not so smart ways to attract an audit or other unwanted scrutiny from the IRS. This tax season, the IRS is gearing up to initiate and intensify its audits of individual taxpayers. But, never fear, there are steps you can take, or rather, not take to minimize your chance of an audit. A lot of this is very simple as well. First, make sure all the 1099 forms you received for dividends, interest, and other investment receipts are reflected somewhere on your tax return. IRS computers have gotten much better at matching the copy of the 1099 sent to the agency with your return, notating any omissions. There are a few not so smart ways to attract an audit or other unwanted scrutiny from the IRS. This tax season, the IRS is gearing up to initiate and intensify its audits of individual taxpayers. But, never fear, there are steps you can take, or rather, not take to minimize your chance of an audit. A lot of this is very simple as well. First, make sure all the 1099 forms you received for dividends, interest, and other investment receipts are reflected somewhere on your tax return. IRS computers have gotten much better at matching the copy of the 1099 sent to the agency with your return, notating any omissions.

Second, if you are claiming large deductions for gifts to charity, make sure you meet all the necessary paperwork requirements. This includes, have a receipt or letter for each donation, no matter how large or small, as well as a letter of acknowledgment for any donation over $250. A canceled check simply does not make the cut as proof. Also, to the IRS, $1953.12 looks a lot more real on a deduction form than $1950. Deductions ending in a bunch of zeros are not your friend.

Last year, the IRS issued a manual to its agents about how to look for and recognize hobby losses. Taxpayers have been attempting to write off their fun and game activity for years, illegally. They label them as businesses and claim them as a loss for self-employment. Any self-employment loss on Schedule C is asking for an audit, especially if the activity, or loss looks like fun.

If you are going to use a tax preparer, make sure you use a reputable accountant. The IRS is aware of dodgy tax preparers and keeps tabs on them (even though they won’t admit to doing so). Be wary of accountants/CPAs who base their fees on a specified cut of the refund, claims to get you bigger refunds than others, or makes any suggestion to claim credits that you are probably not entitled to.

Lastly, and yes, it seems like the biggest no-brainer of them all, do not run around shooting your mouth off about how you put one over on the IRS. The IRS is now authorized to pay big bucks to people who tattle on you. This could land you fines, penalties, and even a period of incarceration. I would recommend to just hire a reliable accountant to take care of your taxes, especially if you don’t have the proper program or patience to sit down and do them correctly yourself.

Tags: audits, cpas, linkedin, receipts, tax preparer, tax return

Posted in CPA Rockvile |

No Comments »

Posted on: March 26th, 2010 by Amy Bolger

Are you one of those people that keeps every receipt, tax return, and bank statement and then box them all up at the end of the year, only to fill your spare bedroom, attic, or garage with unnecessary clutter? Well, then this is for you. As you finish up your tax return this year, take the opportunity to clean house. You don’t need to keep all of those documents. I know going paper-free sounds crazy, but if you are willing to start online banking and create a digital archive of important documents, that too, is a possibility in the near future.

Before you begin tossing, you should invest in a shredder (or a furry friend) to protect your identity. The first things that can go are ATM receipts, bank withdrawal and deposit slips, and credit card receipts once they have been checked against statements. You also only need to keep your pay stubs until you receive your W-2. The last things that you can get rid of are monthly bills (credit card statements, cable bills, utility bills, etc) that you will not be using to write off business expenses. Before you begin tossing, you should invest in a shredder (or a furry friend) to protect your identity. The first things that can go are ATM receipts, bank withdrawal and deposit slips, and credit card receipts once they have been checked against statements. You also only need to keep your pay stubs until you receive your W-2. The last things that you can get rid of are monthly bills (credit card statements, cable bills, utility bills, etc) that you will not be using to write off business expenses.

You should talk to your local CPA in Rockville for guidance on business deductions.

The most important documents to hang on to are your annual tax returns. You should keep the actual returns forever, but you can discard the supporting documents after 3 years. (That’s how long the IRS has to initiate an audit) Included in these papers are thank-you letters from charities and year-end investment statements. Also, be sure to keep records that show the initial purchase price for stocks and mutual funds so you can calculate your basis when you sell them.

You also need to save records pertaining to your house as long as you live in it. Records showing your purchase price and what you spend on improvements may be important when you go to sell your house. An important tax reason to keep these records: If you sell your house at a hefty profit, certain expenses can be used to lower your tax bill. Again, the 3 year rule applies, 3 years after the selling of your home, go ahead and shred the documents.

And finally, hold on to all records showing how much money went into and came out of IRAs and 401(k)s, especially if you have made non-deductible contributions. This is important so you don’t overpay taxes when you withdraw funds. Also, keep any 8606 forms on which you reported non-deductible contributions to traditional IRAs. If you have any questions about this paperwork or want to know the best tax strategies for investing in retirement accounts, you should talk to your financial planner/adviser.

Tags: bank withdrawal, business deductions, business expenses, linkedin, pay stubs, tax return

Posted in CPA Rockvile |

No Comments »

|

|

Check Refund Status

Check Refund Status