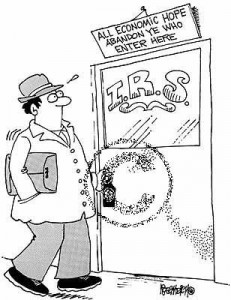

The IRS is using social media to investigate

Posted on: April 12th, 2013 by Amy Bolger While all the information collected by the Internal Revenue Service is protected by strict privacy statutes, the federal tax collector is well within his investigative rights to peruse what you choose to make public. So you might want to reconsider bragging on Facebook about buying a Ferrari when you’re reporting just a $30,000 annual income on your Form 1040. Or at least tighten up the privacy controls on your social media account.

While all the information collected by the Internal Revenue Service is protected by strict privacy statutes, the federal tax collector is well within his investigative rights to peruse what you choose to make public. So you might want to reconsider bragging on Facebook about buying a Ferrari when you’re reporting just a $30,000 annual income on your Form 1040. Or at least tighten up the privacy controls on your social media account.

The IRS reportedly plans to collect personal information from sites such as Facebook and Twitter as part of its continuing effort to catch tax cheats. The added social media attention reportedly will be given to individuals with tax returns that already have raised audit red flags.

This is not a surprise.

Social media ‘spies’

Advertisers already are data mining all our social media activities, seeking ways to manage public attitudes and encourage us to buy their products. On the legal front, criminals are regularly caught because of their ill-advised social media discussions about or videos of their illegal activities. It’s even happened in the tax area. Five years ago, a group of University of Central Oklahoma students bragged on MySpace that their party business had served thousands. That boast caught the attention of the Oklahoma Tax Commission, which promptly issued the young businessmen a $320,000 state tax bill.

I’ll bet Mom and Dad weren’t thrilled when their kids called to ask for help paying the tax collector!

Limited IRS surfing

Will the IRS do the same, using taxpayer information posted on today’s popular social media outlets? Maybe.

But you shouldn’t expect the agency to bring in a lot more money based on social media prompted tax investigations. The main reason is that the IRS already is running on a tight budget. Many workers face furloughs if sequestration cuts continue. And the IRS also recently caught congressional flack for making what some lawmakers saw as frivolous and money-wasting videos, ostensibly for training purposes, in its own in-house production studio. So I suspect that diverting already thin resources to monitor social media sites won’t go over too well on Capitol Hill.

That said, remember that what you say on the worldwide web about your lifestyle could have consequences beyond just impressing your friends.

Best real life example I experienced this past Tuesday – I was involved in a hit and run and did not get the driver’s license plate number. I was able to identify the make and model of the car and had seen the driver. Luckily, it was a nurse that was leaving a hospice and I was able to use Google and social media to find her, as no one at the facility actually knew her name. Myself and the facility staff identified her by her picture online alone. Thank you smartphone. Once you are out there, you are there for anyone to find. Just remember, social media (in my case) can be your friend, or (in the case of the students) be your foe. Be mindful of you put out there.