How to File an Extension

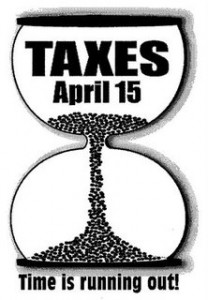

Posted on: April 14th, 2010 by Amy Bolger The tax clock is ticking. It only has days and hours left on it. You can’t turn it back, but there is a way to hit the snooze for 6 more months. Just ask the IRS for more time to file your return. You’ll be in the good company of more than 10 million people. The IRS has made this much easier for taxpayers in recent years. All you have to do or ask your tax preparer/CPA to do is file Form 4868, Application for Automatic Extension of Time to File, either electronically or by US Mail. Remember, though, that an extension to file is not an extension to pay. If you are going to owe taxes when you finally get your return done, you need to pay the money, or an estimated amount close to it, when you ask for the filing extension. This is very important because if the IRS finds that your estimate is unreasonable, it could invalidate your extension request, subjecting you to non-filing penalties. Also, you will owe interest on any underpayment starting from April 15; and if you underpay by more than 10%, you will be subject to an additional penalty.

The tax clock is ticking. It only has days and hours left on it. You can’t turn it back, but there is a way to hit the snooze for 6 more months. Just ask the IRS for more time to file your return. You’ll be in the good company of more than 10 million people. The IRS has made this much easier for taxpayers in recent years. All you have to do or ask your tax preparer/CPA to do is file Form 4868, Application for Automatic Extension of Time to File, either electronically or by US Mail. Remember, though, that an extension to file is not an extension to pay. If you are going to owe taxes when you finally get your return done, you need to pay the money, or an estimated amount close to it, when you ask for the filing extension. This is very important because if the IRS finds that your estimate is unreasonable, it could invalidate your extension request, subjecting you to non-filing penalties. Also, you will owe interest on any underpayment starting from April 15; and if you underpay by more than 10%, you will be subject to an additional penalty.

If you find that your expected tax bill is more than you will be able to afford, you can go ahead and make payment arrangements. When you file your extension, also file Form 9465, seeking an installment payment arrangement. You’ll automatically get up to 3 years to pay the tax balance in monthly installments if the bill is $10,000 or less and you are current with previous years’ taxes. If you need help making these arrangements, you can contact a local accountant to assist you.