Posted on: April 12th, 2013 by Amy Bolger

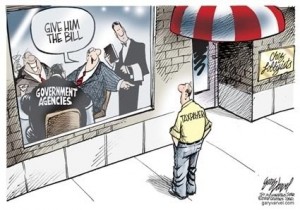

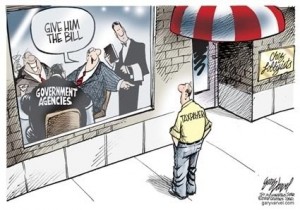

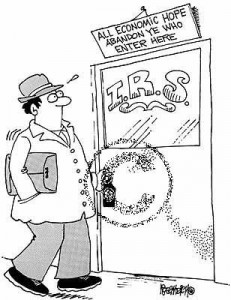

While all the information collected by the Internal Revenue Service is protected by strict privacy statutes, the federal tax collector is well within his investigative rights to peruse what you choose to make public. So you might want to reconsider bragging on Facebook about buying a Ferrari when you’re reporting just a $30,000 annual income on your Form 1040. Or at least tighten up the privacy controls on your social media account. While all the information collected by the Internal Revenue Service is protected by strict privacy statutes, the federal tax collector is well within his investigative rights to peruse what you choose to make public. So you might want to reconsider bragging on Facebook about buying a Ferrari when you’re reporting just a $30,000 annual income on your Form 1040. Or at least tighten up the privacy controls on your social media account.

The IRS reportedly plans to collect personal information from sites such as Facebook and Twitter as part of its continuing effort to catch tax cheats. The added social media attention reportedly will be given to individuals with tax returns that already have raised audit red flags.

This is not a surprise.

Social media ‘spies’

Advertisers already are data mining all our social media activities, seeking ways to manage public attitudes and encourage us to buy their products. On the legal front, criminals are regularly caught because of their ill-advised social media discussions about or videos of their illegal activities. It’s even happened in the tax area. Five years ago, a group of University of Central Oklahoma students bragged on MySpace that their party business had served thousands. That boast caught the attention of the Oklahoma Tax Commission, which promptly issued the young businessmen a $320,000 state tax bill.

I’ll bet Mom and Dad weren’t thrilled when their kids called to ask for help paying the tax collector!

Limited IRS surfing

Will the IRS do the same, using taxpayer information posted on today’s popular social media outlets? Maybe.

But you shouldn’t expect the agency to bring in a lot more money based on social media prompted tax investigations. The main reason is that the IRS already is running on a tight budget. Many workers face furloughs if sequestration cuts continue. And the IRS also recently caught congressional flack for making what some lawmakers saw as frivolous and money-wasting videos, ostensibly for training purposes, in its own in-house production studio. So I suspect that diverting already thin resources to monitor social media sites won’t go over too well on Capitol Hill.

That said, remember that what you say on the worldwide web about your lifestyle could have consequences beyond just impressing your friends.

Best real life example I experienced this past Tuesday – I was involved in a hit and run and did not get the driver’s license plate number. I was able to identify the make and model of the car and had seen the driver. Luckily, it was a nurse that was leaving a hospice and I was able to use Google and social media to find her, as no one at the facility actually knew her name. Myself and the facility staff identified her by her picture online alone. Thank you smartphone. Once you are out there, you are there for anyone to find. Just remember, social media (in my case) can be your friend, or (in the case of the students) be your foe. Be mindful of you put out there.

Tags: form 1040, internal revenue service, linkedin, privacy statutes, tax investigations

Posted in CPA Rockvile |

No Comments »

Posted on: April 9th, 2013 by Amy Bolger

Every tax-filing season, the great quest by filers is to find the most tax deductions. But there are some deductions you should steer clear of. If you claim these wrong write-offs, you’ll deduct expenses that don’t meet Internal Revenue Service guidelines. Simply, that means you’ll end up spending time with a tax auditor and paying more in taxes, penalties and interest. Every tax-filing season, the great quest by filers is to find the most tax deductions. But there are some deductions you should steer clear of. If you claim these wrong write-offs, you’ll deduct expenses that don’t meet Internal Revenue Service guidelines. Simply, that means you’ll end up spending time with a tax auditor and paying more in taxes, penalties and interest.

With the assistance of Bankrate, here is a list of no-nos (but to be fair, there are some related tax breaks included that will pass the through the IRS).

Don’t deduct homeowners insurance, but …

The hazard policy you bought to cover damage from fires, tornadoes, hurricanes, winter storms and other disasters, as well as for more-routine mishaps, offers peace of mind. What it doesn’t provide is a tax deduction for the insurance premiums.

But if you meet some tax law guidelines, you can deduct private mortgage insurance, or PMI on your 2012 tax return. PMI is the insurance your lender requires you to buy if you don’t put down a big enough down payment. PMI premiums are deductible as an itemized expense (it goes on Schedule A with your mortgage interest claim) as long as the mortgage insurance policy was issued in 2007 or later. This tax deduction is in effect through 2013.

You also must meet income requirements. If your adjusted gross income is $100,000 or less (or $50,000 and you’re married and filing separately), your full PMI premium amount is deductible. If you make between $100,001 and $109,000, the amount of PMI that you can deduct is reduced. And if your income is more than $109,000 ($54,500 married filing separately), you can’t deduct PMI at all.

You can figure your allowable PMI deduction using the work sheet in the Schedule A instructions.

Don’t deduct a telephone land line, but …

You can’t deduct the cost of your main home telephone land line, even if you primarily use that phone for your business. The IRS says that the first hard-wired phone line in your home is considered a nondeductible personal expense.

But you can deduct as a business expense the cost of business-related long distance charges on that phone. If you are an employee, they would be claimed as an un-reimbursed business expense on Schedule A. If you are self-employed, you would count the phone calls as an expense on your Schedule C or C-EZ. And if you install a second telephone land line specifically for your business, its full cost is deductible.

Don’t deduct commuting costs, but …

The cost of getting to and from your workplace is never deductible. Taking public transportation or driving to work is a personal expense, regardless of how far your home is from your office. And no, you can’t deduct commuting expenses even if you work during the commute.

But you might be able to deduct some commuting costs if you work at two places in one day, whether or not for the same employer. In this case, you can deduct the expense of getting from one workplace to the other.

You also can deduct some expenses related to other work-related travel, such as visits to clients (current and potential) and out-of-office business meetings. If you’re self-employed, these expenses would go on your Schedule C or C-EZ.

If you’re an employee, travel costs must be claimed as un-reimbursed business expenses. As such, your business and other miscellaneous itemized expenses must exceed 2 percent of your adjusted gross income.

Whatever your business travel situation, be sure to keep good records.

Another idea is to ask your employer to establish a commuter savings account program. This employee transportation fringe benefit lets workers use pretax dollars to purchase mass-transit passes and pay for parking near work.

Don’t deduct your pet, but …

Yes, your dog or cat is a family member. And yes, some insurance companies now include coverage for Fido or Fluffy in auto policies. But your affection for your pet or an insurer’s willingness to pay for some of your domesticated animal’s care doesn’t carry any weight with the IRS. so don’t dare try claiming your pet as a dependent. Yes, as ridiculous as it sounds, there are people out there that have tried it. And yes, it is disallowed by the IRS when the furry facts are revealed.

You can, however, deduct as itemized medical expenses the costs of buying, training and maintaining a guide dog or other service animal to assist a visually impaired or hearing-impaired person, or a person with other physical disabilities.

Don’t deduct Social Security taxes, but …

You lose a lot of income each payday to Federal Insurance Contributions Act, or FICA, taxes, the money withheld from your checks to pay for your future Social Security benefits. The debate as to whether Social Security will be around when you retire is still raging. But one thing is sure: Don’t even think about trying to deduct these taxes.

But if you overpaid this tax, you can get a credit for your Social Security over-withholding. There is a limit on how much FICA taxes can be contributed each year. The tax is withheld on up to the Social Security earnings base, which is adjusted annually for inflation, and which for 2012 is $110,100 and for 2013 is $113,700.

If you had multiple jobs and your combined earnings exceeded the wage base, you probably had too much FICA withheld. You can claim the excess Social Security tax as a credit when you file your tax return.

Don’t deduct plastic surgery, but …

If you simply are following your inner Joan Rivers, the IRS definitely won’t let you deduct the costs of your nips and tucks. The IRS specifically says you generally cannot include in deductible medical expenses the amount you pay for procedures such as face lifts, hair transplants, hair removal (electrolysis) and liposuction.

But if a surgery is medically prescribed, for instance, a nose job to treat respiratory issues, and you just happen to like the look of your new sniffer, then that’s OK. The doctor’s decision makes it a medical deduction.

The IRS says: “You can include in medical expenses the amount you pay for cosmetic surgery if it is necessary to improve a deformity arising from, or directly related to, a congenital abnormality, a personal injury resulting from an accident or trauma or a disfiguring disease.”

Remember, all your medical expenses, including any allowable plastic surgeries, must come to more than 7.5 percent of your adjusted gross income on your 2012 Schedule A before you can claim them. For the 2013 tax year, the medical deduction threshold is 10 percent of your AGI.

Don’t deduct dry cleaning, but …

Looking sharp at work rests totally on your shoulders. A recent U.S. Tax Court ruling reaffirmed this tax law when the judge disallowed a television anchorwoman’s deductions for tens of thousands of dollars in clothing she bought to wear on air.

But you can deduct the cost of dry cleaning or laundry of business uniforms. Under the tax code, that means attire you can’t wear anywhere else, although with the ways some folks dress today, that designation could be hard to nail down.

When an outfit is “not suitable for everyday use,” the IRS says the costs of upkeep for the apparel can be claimed as an un-reimbursed business expense on Schedule A. Also deductible are the cleaning charges for nonprofit uniforms, for example, an outfit required of hospital volunteers or Boy Scout or Girl Scout troop leaders. Here the costs of the uniform and its maintenance would count as charitable deductions, also claimed on Schedule A.

Don’t deduct time for volunteer services, but …

Your time is valuable, but that doesn’t matter to the IRS when it comes to volunteering at a charity. You can’t claim the value of your wages for the hours spent helping out at your favorite nonprofit. Neither can you count as a deduction the value of a project you created, such as a poster that you, a graphic artist, designed for the charity.

But you can deduct other costs associated with your charity work. This includes your mileage in connection with the group’s work, which can be claimed on Schedule A at the rate of 14 cents per mile. You also can claim as a charitable deduction un-reimbursed out-of-pocket expenses.

As with all things tax, keep good records. Track your charitable travel and hang on to the receipts for the poster board and special markers you bought just for the nonprofit’s poster project.

Don’t deduct OTC medication, but …

Headache and cold treatments from your neighborhood pharmacy shelves have never been tax deductible. There was some confusion here because for a while, the IRS allowed owners of medical flexible spending accounts, or FSAs, to use money in those pretax accounts to pay for over-the-counter drugs.

That option ended when 2011 began. Now you must get a doctor’s prescription for OTC medications before the purchase can be reimbursed with FSA funds. But you still can deduct diagnostic tests, such as store-bought tests for pregnancy and diabetic blood sugar levels.

And the IRS says moms get a tax deduction on breast-feeding supplies, including pumps and bottles, because, like obstetric care, “they are for the purpose of affecting a structure or function of the body of the lactating woman.”

Don’t deduct kids’ overnight camp costs, but …

When school lets out for the summer, working parents face a child care dilemma: what to do with the youngsters while Mom and Dad are at the office.

Some families send the kids off to summer camp. That’s a great experience for the kiddos and eases, at least temporarily, parental child care concerns. But sleep-away camps, in the summer or any other time of the year, are not tax deductible.

However, if you decide instead to keep the kids at home and simply send them to day camp during the hours you’re working, that expense could qualify as a claim for the child and dependent care credit.

If your care costs are for one child, you can count up to $3,000 of care expenses each year toward the credit. The expense amount is doubled for the cost of caring for two or more dependents.

Your actual tax credit can be up to 35 percent of your qualifying expenses, depending upon your income. And while that might not seem like a large percentage, remember that since it’s a credit, you get to use it to offset your tax bill dollar for dollar.

If you have further inquiries, contact Eric Bach at Eric L. Bach, CPA for a free consultation and all your tax questions. We work to make your taxes work toward your best interest.

Tags: adjusted gross income, internal revenue service, linkedin, mortgage interest, tax auditor, tax deduction, tax deductions, tax filing

Posted in CPA Rockvile |

No Comments »

Posted on: March 14th, 2013 by Amy Bolger

A tax-preparation software glitch caused more than 600,000 returns to be filed incorrectly, delaying refunds by as much as six weeks, the IRS says. A tax-preparation software glitch caused more than 600,000 returns to be filed incorrectly, delaying refunds by as much as six weeks, the IRS says.

H&R Block, the nation’s largest tax preparer, confirmed that its software failed to fill out a mandatory field on Form 8863, which is used to claim educational credits. The IRS would not say what percentage of the roughly 600,000 faulty returns came from H&R Block, but the company received thousands of complaints on its Facebook page and on Twitter. An Internet search did not yield similar complaints against other tax preparers.

The snafu is affecting about 10% of the 6.6 million tax returns containing Form 8863, IRS spokeswoman Michelle Eldridge says. Those taxpayers may have to wait six more weeks before they receive their refunds, she says, adding that the IRS is hoping to reduce that wait time.

H&R Block confirms there is an issue with tax returns filed before Feb. 22 because the IRS changed the way it processes some of the yes or no questions on the form. While in previous years, leaving a field blank to indicate “No” on certain questions was acceptable, the IRS is now requiring preparers to enter an “N.” As a result, H&R Block says, it is working with the IRS to clear these errors, but the company would not give details on how it is correcting returns or exactly how long taxpayers will have to wait for their refunds. The IRS says it is able to keep processing these returns now that it is aware of the system-wide error, but that affected taxpayers will still face delays because of extra steps needed to correct the issue.

The error is creating delays for taxpayers who, following the fiscal-cliff deal, already had to wait an extra two weeks before filing their returns, many of whom were counting on their refunds to pay their bills.

Leslee Napier, a 26-year old nursing student in Princeton, Ind., prepared her return with H&R Block on Jan. 24 so that it would be one of the first returns accepted on Feb. 14, when the IRS began processing forms for education credits. But weeks after her return was supposed to be accepted, the “Where’s My Refund” tool on IRS.gov said her return was still being processed. It wasn’t until more than three weeks after her return was supposed to be accepted that an IRS agent told Napier her return was being held because of issues with Form 8863 and that it might be four more weeks before she receives her refund. “I was worried all this time that I did something wrong or that I was being audited,” says Napier, who is waiting on her refund to pay off a $600 line of credit she opened with H&R Block in December to get her through the holidays. Meanwhile, interest charges are piling up, she says, and she is waiting to catch up on bills and buy new clothes for her 2-year-old daughter.

For students, the delays come at a time when many are facing state deadlines for applying for financial aid: the Free Application for Federal Student Aid, the form for applying for federal financial aid, requires tax information. Elizabeth Havens, a student in South Carolina, says she took a copy of her return to her school so that she could move ahead with her financial aid application while she waits for IRS approval.

Students still waiting on their returns to be processed can manually enter their financial data on the FAFSA and then return to update the information once their returns have been accepted, according to the IRS.

Maybe you should look for a BETTER tax professional.

Tags: educational credits, form 8863 irs, linkedin, tax preparation software, tax preparer, tax preparers, tax returns

Posted in CPA Rockvile |

No Comments »

Posted on: March 10th, 2013 by Amy Bolger

Social Security is America’s largest source of retirement income. But most of us have little or no idea how it works. Worse yet, misinformation causes many to make poor retirement decisions. Here are the facts you need to know. Social Security is America’s largest source of retirement income. But most of us have little or no idea how it works. Worse yet, misinformation causes many to make poor retirement decisions. Here are the facts you need to know.

First, some background. Social Security is insurance, paid for by workers and employers. Only workers and their families benefit from it. It insures against loss of your work income due to retirement (or age), disability or death. It has an annual cost of living adjustment (COLA) equal to the inflation rate, to protect your long-term buying power.

Mystery #1: Will Social Security be there for me? Social Security can pay 100% of all promised benefits until 2033. After 2033 it can pay about 75% of promised benefits. There are numerous options to extend solvency indefinitely with a mix of tax increases and/or benefit cuts. If you’re a pessimist, subtract 25% from your SSA benefit estimate.

Mystery #2: Is Social Security a good deal? Social Security is a complete package of worker benefits, including retirement, disability and life insurance. The average worker earning $43,000, with a non-working spouse, would need to save over $700,000 to duplicate their retirement payments, plus buy additional disability and life insurance. The Social Security Administration’s administrative overhead is a low 0.8%. Social Security payments are at least 15% tax-free.

Mystery #3: How does Social Security compute my payment? Your payment is based on three steps:

- Once eligible, your payment is based on averaging your 35 highest-paid work years (or fewer years for mid-career disability or death).

Mystery #4: How can I get the most lifetime payments—by filing early, at FRA, or later? It’s an individual and financial-planning decision. In simple dollars, it’s best to apply later, if you have average life expectancy or above. But in ”present value” dollars, counting inflation, taxation, withdrawal options and interest rates, it may be best to apply early. See this post for some considerations and software resources.

Mystery #5: What are good Social Security planning tools? Definitely sign up for a ”My Social Security” account at www.ssa.gov/myaccount/. See SSA’s suite of calculators at www.ssa.gov/OACT/anypia/index.html. And see the software products at the link in Mystery #4.

Mystery #6: Will Social Security pay my family members? Yes, in certain circumstances.

- Your spouse or former spouse can get up to 50% of your FRA payment if they are at least FRA; less if they file early (as early as age 62).

- Your spouse can be paid 50% at any age if caring for your child under 16.

- Your unmarried child can be paid 50% if under 18, under 19 and in high school, or at any age if totally disabled since youth.

- In most cases, your family member must first file for any benefits on their own work record. (An exception is your spouse who is over FRA.)

Mystery #7: Can family members receive Social Security after I die? Yes. Payments to your survivors are possible whether you die before or after your own Social Security eligibility.

- Your widow(er) or surviving former spouse can be paid up to 100% of your payment if they are at least FRA, or a reduced amount as early as age 60.

- Your widow(er) can be paid 75% at any age, if caring for your child under 16.

- Your unmarried child can be paid 75% if they are under 18, under 19 and in high school, or any age if totally disabled since youth.

- Your parent over 62 can be paid if they were dependent upon you.

Mystery #8: Can I work and still get Social Security? Yes. If you are over FRA, there is no work limit; you can earn as much as you can and still get full Social Security payments. Before FRA, some of your Social Security is withheld if your earnings exceed the annual earnings threshold, $15,120 in 2013. (Higher limits apply the year you turn FRA.) Only work income counts against Social Security; not counted are pensions, interest, dividends, capital gains, etc. Remember, your Social Security does not stop as soon as you reach the threshold; that’s where partial withholding begins. If you get Social Security disability, different work rules apply.

Mystery #9: How do I file for Social Security? You can file by visiting an office, by calling (800) SSA-1213, or online at www.ssa.gov. You can file up to 3 months before you want payments to begin.

Mystery #10: When can I enroll in Medicare? Medicare age is 65. You should file promptly by contacting SSA (see Mystery #9), preferably 2-3 months early. Late filing causes penalty fees and delayed coverage. If you are covered by health insurance from current work done by you or your spouse, you can postpone Medicare until that insurance or work ends. Note that it must be insurance from current work, not a retiree plan or COBRA. Everyone should contact SSA 3 months before their 65th birthday to make sure their Medicare enrollment is on track.

You now have a good start at understanding your retirement’s cornerstone. For more detail, see my book![]() . But remember, everything here has individual nuances and exceptions. Only SSA can make official decisions, so be sure to study their website and consult with them by phone or in-office. . But remember, everything here has individual nuances and exceptions. Only SSA can make official decisions, so be sure to study their website and consult with them by phone or in-office.

As always, keep on planning.

Tags: cost of living adjustment, linkedin, retirement age, retirement decisions, retirement income, retirement payments, social security administration, social security payments

Posted in Financial Planning Rockville |

No Comments »

Posted on: February 24th, 2013 by Amy Bolger

The IRS expects that 75 percent of all 2012 returns will be entitled to a refund, so if you haven’t started preparing your taxes yet, time to get on it: There is no reason to wait for April 15 to roll around to get that money back from Uncle Sam. And remember: If you do not file your return by the due date, you may have to pay penalties and interest. Even if you can’t meet the deadline, you can file for an extension, which will give you until October 15 to file your 2012 tax returns. The IRS expects that 75 percent of all 2012 returns will be entitled to a refund, so if you haven’t started preparing your taxes yet, time to get on it: There is no reason to wait for April 15 to roll around to get that money back from Uncle Sam. And remember: If you do not file your return by the due date, you may have to pay penalties and interest. Even if you can’t meet the deadline, you can file for an extension, which will give you until October 15 to file your 2012 tax returns.

UPDATES for 2012:

- The IRS is providing taxpayers whose incomes are $57,000 or less with “Free File“, available through IRS.gov, where a number of tax software companies make their products available for free. Additionally, some states are offering similar options. Electronic e-filing is available to all taxpayers, regardless of income.

- Mailing your return: If you are filing a paper return, you may be mailing it to a different address this year because the IRS has changed the filing location for several areas. See Where To File for a list of IRS addresses.

- Exemption amount: $3,800 from $3,700 in 2011.

- Standard deduction: For married couples filing a joint return, the standard deduction is $11,900 for 2012. For single individuals and married couples filing separate returns, it is $5,950 and for heads of household it increases by $200 to $8,700 for 2012.

- Tax-bracket thresholds increase for each filing status. For a married couple filing a joint return, for example, the taxable-income threshold separating the 15% bracket from the 25% bracket is $70,700, up from $69,000 in 2011.

- Estate and gift tax: The exclusion amount for 2012 is $5,120,000. The exclusion for gifts to a spouse who is not a citizen of the United States increases to $139,000 for 2012.

- Itemized deductions and personal exemptions: The itemized deduction limitation and personal exemption phase-out rules were repealed for 2011 and 2012, which means taxpayers can deduct the full amount of their itemized deductions and personal exemptions in 2012. These limitations ($250,000 for individuals and $300,000 for joint filers) will go back into effect for tax year 2013

Get ALL your Credits:

Tax credits are the best tax deal going, because they reduce your taxes dollar for dollar, instead of being calculated based on your tax bracket.

Earned Income Tax Credit (EITC) is a refundable credit for low and moderate income workers and working families. The 2012 income limit for the EITC is under $50,270 for joint filers and under $45,060 for singles and the maximum credit is $5,891. The credit varies by family size, filing status and other factors, with the maximum credit going to joint filers with three or more qualifying children. Use Schedule 8812 to figure your additional child tax credit for 2012. (Details are in IRS Publication 596 — PDF)

Child Tax Credit is up to $1,000 for each qualifying child who was under the age of 17 at the end of 2012. This credit can be claimed in addition to the credit for child and dependent care expenses, but phases out for married couples that earn more than $110,000 and single filers who earn more than $75,000. In an IRS-esque type move, taxpayers should use Schedule 8812 (instead of Form 8812) to figure the additional child tax credit. (Details are in IRS Publication 972 — PDF)

Child and Dependent Care Credit is available if you pay someone to care for a dependent under age 13, so that you can work or look for a job. The credit is 20 to 35% of your child-care expenses up to $6,000 (the size of your credit depends on your income). This credit will be reduced significantly next year. (Details are in IRS Publication 503 — PDF)

Retirement Savings Contributions Credit is designed to help low and moderateincome workers save for retirement. Individuals with incomes of up to $28,750, head of households with $43,125 and married couples with joint incomes of up to $57,500 may qualify for a credit of up to $1,000 per person. (Details are in Form 8880 — PDF)

Energy and Appliance Tax Credit If you made any energy-efficiency improvements to your home in 2012, you may be eligible for a tax credit of 10 percent for the cost, up to a maximum of $500. Approved improvements include new windows, insulation, high efficiency furnaces, water heaters and air conditioning, among many. Be sure to keep your receipts and manufacturer certification. (See which Energy Star items qualify for the tax deduction and use IRS Form 5695)

Adoption Tax Credit in 2012 has reverted to being nonrefundable, with a maximum amount (dollar limitation) of $12,650 per child from $13,360 in 2011. The income limit on the adoption credit is based on your modified adjusted gross income (MAGI). For tax year 2012, the MAGI phase out begins at $189,710 and ends at $229,710. (IRS Topic 607)

College Costs

American Opportunity Tax Credit: For tax year 2012, students can claim a $2,500 “higher education tax credit” for the first four years of college. The credit is based on 100 percent of the first $2,000 of tuition and related expenses, including books, paid during the tax year, plus 25 percent of the next $2,000 of tuition and related expenses paid during the tax year (subject to income phase-outs starting at $80,000 for singles and $160,000 for joint filers).

Lifetime learning credit: The modified adjusted gross income threshold at which the lifetime learning credit begins to phase out is $104,000 for joint filers, up from $102,000, and $52,000 for singles and heads of household, up from $51,000.

Tuition and fee deductions: Every family can deduct up to $4,000 of college tuition and fees in 2012, subject to income limitations. If your modified AGI is between $65,001 and $80,000 for singles or between $130,001 and $160,000 for joint filers, you are entitled to a reduced deduction of up to $2,000. (IRS Publication 970)

Student loan interest deduction: The $2,500 maximum deduction for interest paid on student loans begins to phase out for a married taxpayers filing a joint returns at $125,000 and phases out completely at $155,000, an increase of $5,000 from the phase out limits for tax year 2011. For single taxpayers, the phase out ranges remain at the 2011 levels.

Itemized Deductions: Nearly two out of three taxpayers take the standard deduction rather than itemizing deductions, such as mortgage interest, charitable contributions and state and local taxes. You may be leaving money on the table. If your deductible expenses exceed the 2012 standard deduction limits above, be sure you itemize and grab these write-offs.

Miscellaneous deductions: These are deductible if they total more than 2 percent of your adjusted gross income. They include tax-preparation fees, job-hunting expenses, business car expenses, and professional dues.

Sales tax: You can deduct sales tax paid in 2012 if the amount was greater than the state and local income taxes you paid. In other words, you get to choose: Write off your sales taxes or write off your income taxes. If you didn’t keep your sales-tax receipts, use the IRS’s sales tax deduction estimator. Even if you claim the sales tax amount from the IRS tables, you can add in tax paid on vehicles or boats purchased during the year, except to the extent the sales tax rate on them is more than the general sales tax rate. If you live in a state with a high income tax, like California or New York, you will probably be better off claiming your state and local income taxes rather than sales taxes. If you live in a state with no income tax, like Florida, Texas, or Washington, be sure to take the sales tax deduction when you itemize.

Medical expenses: This one is hard to claim, because the bar is so high to qualify. You can only deduct the portion of your 2012 medical expenses that exceed 7.5 percent of your adjusted gross income.

Mileage: Deducting miles driven for work or other purposes can be a huge tax break and save you significant money. The 2012 rate for business use of your car remains 55.5 cents a mile; medical and moving is 23 cents per mile; and charitable use is 14 cents per mile.

Mortgage insurance deduction: Borrowers with AGI’s up to $100,000 may be able to treat qualified mortgage insurance as home mortgage interest, which means that 100 percent of 2011 premiums may be deductible. The insurance contract had to be issued after 2006 and deductions are phased out in 10 percent increments for homeowners with AGI’s between $100,001 and $109,000. (IRS Publication 936)

Classroom deduction for teachers: K-12 educators who work at least 900 hours during the school year can claim an above-the-line deduction of up to $250 ($500 if married filing joint and both spouses are educators, but not more than $250 each) for any un-reimbursed expenses (books, supplies, computer equipment (including related software and services), other equipment, and supplementary materials) used in the classroom. (IRS Topic 458)

IRA/Roth Conversion

When you contribute to an individual retirement account, you help fund a future goal while lowering your current tax bill. In other words, socking cash in an IRA is like saving with help from your Uncle Sam.

You have until tax filing to contribute up the lesser of your taxable compensation for the year or $5,000 to a 2012 IRA ($6,000 if you are 50 or older). If you are self-employed, have a Keogh or SEP-IRA, and have filed for an extension to October 15, you can wait until then to put 2012 money into those accounts.

Even if you’re covered by a retirement plan at work, you can deduct some or all of your IRA contribution. The 2012 IRA limits for modified AGI as follows:

- More than $92,000 but less than $112,000 for a married couple filing a joint return or a qualifying widow(er)

- More than $58,000 but less than $68,000 for a single individual or head of household, or

- Less than $10,000 for a married individual filing a separate return.

For married couples filing a joint return, in which the spouse who makes the IRA contribution is not an active participant in an employer-sponsored retirement plan but the other spouse is a participant, the deduction is phased out if the couple’s income is between $173,000 and $183,000, up from $169,000 and $179,000 in 2012.

Charitable donations from IRA’s: Taxpayers aged 70 1/2 or older can make direct tax-free transfers of up to $100,000 from IRAs to qualified charities. The transfers can satisfy minimum required distributions without increasing adjusted gross income.

Roth IRAs

Roth IRAs allow taxpayers to invest money for future retirement needs. Unlike a traditional IRA, there is no current tax deduction available for contributions to a Roth and all funds within the Roth IRA compound tax-free and all withdrawals from the account are also tax-free. To qualify to contribute to a Roth, your income must fall within the Modified Adjusted Gross Income (MAGI) limits. The 2012 limit for 2012 is $173,000 to $183,000 for married couples filing jointly, up from $169,000 to $179,000. For single taxpayers, the income phase-out range is $110,000 to $125,000, up from $107,000 to $122,000 in 2011.

Roth conversion: If you converted or rolled over an amount to a Roth IRA in 2010 and did not elect to report the taxable amount on your 2010 return, you generally must report half of it on your 2011 return and the rest on your 2012 return. (See Publication 575 for details)

Tags: e filing, free file, linkedin, preparing your taxes, tax bracket, tax software

Posted in CPA Rockvile |

No Comments »

Posted on: November 16th, 2012 by Amy Bolger

Up in the air about refinancing your mortgage?

That’s okay. Refinancing, which is essentially the process of paying off your existing mortgage with a new one, isn’t the right option for everyone. And for this reason, it’s important to weigh out the pros and cons.

By doing so, you can determine if you’ll actually benefit from refinancing.

For example, you could be lowering your interest rate by 25 percent, but if that comes with thousands of dollars in closing costs, it could take a long time to break even, says Shashank Shekhar, a loan originator with Arcus Lending in San Jose, California.

Not an easy decision is it? To help, we’ve hashed out the pluses and minuses of refinancing to see if it makes sense for you and your  financial situation. financial situation.

PROS:

1) This is perhaps the biggest pro of refinancing your mortgage: a lower interest rate.

Of course, you’ll need to first qualify for the lower rate, but if you do – you could be saving a lot of money. In fact, even an interest rate that’s a half percent less could garner a good chunk of savings.

Just consider this example from the Federal Reserve, which compares the monthly payments on a 30-year fixed-rate loan of $200,000 at 5.5 and 6 percent interest.

2) What exactly is the benefit of refinancing to a shorter term mortgage, you ask?

For starters, shorter-term mortgages – like a 15-year mortgage versus a 30-year mortgage – generally has lower interest rates, according to the Federal Reserve.

What’s more, the shorter your mortgage term, the sooner you’ll be out of debt and the less interest you’ll have to pay in the long run.

For example, the Federal Reserve says to compare the total interest costs for a fixed-rate loan of $200,000 at 6 percent for 30 years with a fixed-rate loan at 5.5 percent for 15 years.

While the total interest savings are indeed significant, “The trade-off is that your monthly payments usually are higher because you are paying more of the principal each month,” says the Federal Reserve.

3) Cheat sheet: an interest rate on a fixed-rate mortgage (FRM) remains the same for the life of the loan, while an interest rate on an adjustable-rate mortgage (ARM) adjusts periodically based on an index.

And if you currently have an ARM, now is a great time to refinance to an FRM.

In fact, with rates at historic lows, an average of 3.39 percent on a 30-year fixed-rate mortgage as of November 1, according to federal lender, Freddie Mac, there may not be a better time to refinance.

“Given the uncertainty in the real estate market and the historical low rates on offer now, I always advise my clients to go with a FRM wherever possible,” explains Shekhar.

So, to avoid any uncertainty with your mortgage payments, you may want to refinance and lock in today’s record-low rates.

If you’re still unsure, then consider this: If you stick with an ARM and rates go up in the next few years, will you be in utter regret?

CONS:

1) Have you struggled to make your last few credit card payments? Has your credit score suffered as a result?

If so, refinancing may not be in your best interest, especially since a bad credit score often means having a higher rate when you refinance, explains Shekhar.

“For every 20 point drop in credit from 740, you pay higher in closing cost, interest rate, or both,” says Shekhar. “In some cases, your closing cost can increase by 2 percent or more.”

As you can see, a bad credit score could definitely work against you during the refinancing process.

So, before you refinance, it might be a good idea to try and improve your score by paying credit card bills on time and keeping balances low on your credit cards, according to myFICO, the consumer division of the Fair Isaac Corporation, which provides a global standard for measuring credit risk.

2) Getting a lower interest rate sounds great, right? Of course it does. But like most things in life, there are costs that come with refinancing – and these costs could really add up.

“It is not unusual to pay 3 percent to 6 percent of your outstanding principal in refinancing fees,” according to the Federal Reserve, which adds that fees could include an application fee, loan origination fee, an appraisal fee, and more. “These expenses are in addition to any prepayment penalties or other costs for paying off any mortgages you might have.”

A prepayment penalty, in case you’re wondering “is a fee that lenders might charge if you pay off your mortgage loan early, including for refinancing,” according to the Federal Reserve.

So, before you refinance, you’ll want to do some research and make sure that the refinancing savings will outweigh any and all fees.

3) Planning to move out of your home in the next few years? If so, it may not be the right time to refinance.

Why? Because if you move soon after you refinance, “The monthly savings gained from lower monthly payments may not exceed the costs of refinancing,” the Federal Reserve says.

If you will be moving – and you still want to refinance – the Federal Reserve suggests using a break-even calculation, which could help you figure out whether it’s a smart decision.

Unfortunately, sudden changes like job relocation or a divorce may be out of your hands.

But if you do sense that the future in your home is a bit unstable, you may want to hold off on refinancing.

Tags: existing mortgage, financial situation, fixed rate loan, interest costs, interest savings, refinancing your mortgage, term mortgages

Posted in Financial Planning Rockville |

No Comments »

Posted on: November 14th, 2012 by Amy Bolger

Winter is dark, cold, and expensive, at least where heating a home is concerned. The cost of heating oil climbs each winter and electricity is not cheap. Winter is dark, cold, and expensive, at least where heating a home is concerned. The cost of heating oil climbs each winter and electricity is not cheap.

It’s hard to know what changes can be made to help lower your bills, but help is a just a phone call away. The local electric company is happy to assess your needs, family lifestyle and patterns of energy usage. They will go through your home to check for areas to be improved. They will survey your appliances, inspect the home’s structure, and measure your insulation. Once done they will make suggestions and help implement needed changes for more efficient energy consumption. Often times the suggestions will come with rebate incentives that will help reduce your bill.

Whether you are in a new house or an older one, drafty windows, doors and attics will allow air to sneak out and along with it heat. It is important to seal up any air leaks to keep heat inside. Start by checking the weather stripping around your windows and doors; replace if it appears worn. Next, check for any leaks where hot air can seep out into an unfinished attic space. Cuts made into the drywall to install lighting fixtures and ceiling fans create easy escape routes for air too. Seal the openings using a silicon or latex caulk. By sealing air leaks, you can realize about 30 percent in energy savings.

It is very tempting to set your thermostat for a comfortable 75 degrees during the winter months, but it is a sure-fire way to boost your energy expenses.

The lower the setting, the more savings you will realize. The commonly agreed upon lowest comfortable setting is sixty-eight degrees. If you keep it at 68 during the day, your savings can be 6.2%, and for every degree above that, costs will go up. For example, a room that is 75 can cost 15 percent more.

While 68 may seem chilly, you can always wear a sweater and comfortable socks to stay warm. Setting the thermostat at 62 overnight will also save on your energy bill. If you leave for a few days, turn the temperature down to 55, which is the lowest setting without the pipes freezing.

Insulation is perhaps the most important feature to keeping a home warm in the winter and cool in the summer. To save money make sure you have the proper level of insulation in both the attic and between the inside walls. Insulation has an R-value measured by the amount of heat allowed to pass through it. The higher the value the less likely heat will escape, resulting in lower energy bills. Heat rises and easily escapes through an attic if not properly insulated. Heat losses can add close to 30 percent to your energy bill too.

Fireplaces are excellent sources of heat and can warm a room in a matter of minutes. Snuggling with a cup of hot cocoa and a good book in front of a fire is a relaxing way to spend a cold winter evening too.

Fireplaces do have their drawbacks, though. Similar to air leaks in drywall and unfinished attic spaces, a fireplace damper left open when not in use is a welcomed invitation for heated air to escape and cold air to funnel into your home. After every use close the damper and more importantly, open it before you decide to enjoy a cozy fire or your home will fill with smoke.

Air vents and radiators can be eyesores in a room; designed to be functional, not pretty. In an effort to be pretty, furniture or window treatments often hide the air vents. Pretty screens can cover the radiators to hide the unsightly monsters also, but these methods only serve to obstruct the airflow, making the furnace work much harder.

It is best to accept that they are rather ugly and keep the airflow moving freely throughout the space. One trick that will help to hide these while not hindering airflow is to paint them the same color as the wall or the flooring so they fade into the background.

High ceilings are wonderful features in a room, but can increase your heating bills as warm air rises, trapping it close to the ceiling. If you have a ceiling fan, change the direction of the blades. Instead of it circulating to cool the hot air set it to push the air downward along the walls by reversing the flow of the fan. Circulating the air back through the room will heat the room more evenly and ease the effort your heater needs to keep the room at a comfortable temperature.

Window treatments are beautiful features in a cozy living room or romantic bedroom, but they can serve a great purpose besides adding color to a space. Full drapes made of a wool cotton blend when opened will let a natural source of heat, the sun, into the room and warm it up. In the evening, as the sun goes down and temperatures dip, closed curtains help to insulate a room from the cold air seeping through the windows. Line the window treatments and you will provide more insulation and another layer to keep out the chill in the evening.

It may seem like a great idea to turn on a space heater for a little extra warmth in a small space, but they pose several threats. First, they are expensive to run regardless of the type. Electrical ones just run up your bill and kerosene can be costly. Second, they are dangerous. All it would take is for someone to knock it over, which could start a fire or cause personal injury. The perceived savings are not worth the risk of burning down the house.

Area rugs often add color and style while unifying a space. During the cold winter months, they serve an important function, too. Rugs add another layer of insulation to the floor, trapping the cool air underneath and keeping it from seeping up and cooling the room. The warmth of the rug will keep your feet toasty too.

Tags: drafty windows, efficient energy, energy consumption, energy expenses, energy savings, lower your bills

Posted in Latest News |

No Comments »

Posted on: November 9th, 2012 by Amy Bolger

Options are one the most versatile trading instruments ever invented. Since options cost less than stocks, they provide a high leverage approach to trading that can significantly limit the risk of a trade. Simply, option buyers have rights and option sellers have obligations to the buyers. Option buyers have the right to buy or sell the underlying stock at a specified price until the third Friday  of their expiration month. of their expiration month.

There are types of options: calls and puts. Call options give you the right to buy the underlying asset, whereas put options give you the right to sell the underlying asset. Before stepping away from your financial manager, it is important that you get to know the inner workings of both. Every investment strategy you will have or be given by investment advisers will require your working knowledge of both types of options.

There are no margin requirements if you want to purchase and option because your risk is limited to the price of the option. In contrast, option sellers receive a credit in their account for selling an option and get to keep this amount if the option expires worthless. However, option sellers also have an obligation to buy or sell the underlying instrument if their option is exercised by an assigned option holder; therefor selling an option requires a healthy margin.

The price of the option is called the premium. An option premium is priced on a per share basis and each option on a stock corresponds to 100 shares. Therefor, if an option premium is priced at 2, that corresponds to 200 shares in the company’s stock. Yes, this all does sound a bit confusing at first, but if you sit down with a financial adviser and educate yourself with reference material on the subject, you will be better able to make financial decisions on your own.

Tags: financial adviser, financial decisions, financial planning, investment advisers, investment strategy, stocks

Posted in Financial Planning Rockville |

No Comments »

Posted on: November 7th, 2012 by Amy Bolger

With the cost of college continuing to rise and the economy still stagnating, the student debt burden has swollen to a record $1 trillion. With the cost of college continuing to rise and the economy still stagnating, the student debt burden has swollen to a record $1 trillion.

Mark Kantrowitz, publisher of Fastweb.com and FinAid.org, believes that one of the main culprits behind the student debt crisis is the private student loan sector.

“Students are following their dreams and don’t pay attention to their debt,” Kantrowitz says. “They sign whatever piece of paper is put in front of them, figuring they’ll pay it back when they graduate.”

Unlike federal loans, private loans usually come with variable interest rates that seem low at first glance but can skyrocket by 5 points over the loan’s lifetime. They also offer far fewer options for cash-strapped graduates struggling with payments, such as deferment, lengthy forbearance periods and income-based relief.

And since it’s next to impossible to discharge student loan debt in bankruptcy, millions of students are left drowning in private debt they have no hopes of ever paying off.

Last year, the Consumer Financial Protection Bureau (CFPB) put out a call for consumers to share their student loan stories on its message board and get the ball rolling on lending reform.

But for these nine commenters, it may already be too little, too late.

Besides being one of the millions of college graduates (from a for profit school nonetheless) that, at one point, was unemployed and had absolutely no way of paying my loans, here are a few other horror stories many of us can relate to:

Steve Macintyre: $100,000 in debt and out of a job

“I used to work in the entertainment industry but have been unemployed for a few years and I needed to desperately update my skillset if I could hope to find a job in the highly competitive field of games and animation.

Searching for various schools, I kept seeing advertisements for the Art Institute and talked with one of their recruiters and was told wonderful stories about how the school was accredited, how students went on to successful careers, etc.

I told them I wanted to get a degree in Game Art and Design but was told I could but needed to take the Graphic Design course first. I didn’t think much of it at first, but I agreed. I was dismayed at the quality of the classes…(Now) I’m stuck with over $100,000 dollars in debt, which qualifies as theft as I received nothing substantive in return.

I actually had to sign up for other courses outside the school in order to successfully complete assignments! Courses that offered REAL *VIDEO* Instruction at a fraction of the cost ($35 dollars per month as opposed to $2000+ dollars!) and by a company that trains people in the industry.

It’s now 8 months since loans have run out and I couldn’t complete my degree and I’m still looking for work.”

Michael Speck: Passing on a generation of debt

“I have three degrees, including an MA and a JD. When I graduated from law school in ’99 all of the offers – with the exception of those from the upper echelon firms that essentially own you – were for little money, leaving next to nothing for living expenses.

Now I am making a decent living and can pay my loans under the (Income-based repayment) program, but repayment is a distant dream. As a result, I am unable to assist my son with his education expenses (thereby effectively making the debt trans-generational), or buy a home, start my own practice, etc.

As a macro-economic problem, those of us saddled with this debt are unable to fully participate in the economy.”

Dgoeck: Stuck with a clunker – indefinitely

“I’m not really sure what to do at this point. I am a victim of a for-profit school that definitely seemed in cohorts with Sallie Mae. My original loan was $80,000 but has grown to $135,000 and all I can pay is interest only, which is already $700 a month.

It’s ridiculous how sad this market has become. No one offers consolidation anymore or those that do will pin you at a ridiculous interest rate.

I am definitely in this for life… It looks like I will be stuck living in a low-rate apartment for the rest of my life and drive a 15-year-old car. I’m at least glad I found a really good job in the industry I was hoping for, but these loans are a real burden. Just thinking about them hurts my overall outcome each and every day.”

KDF11: Dogged by debt collectors

“I am a graduate (doctoral) student with a 2005 loan from Bank of America which was passed to American Education Services. AES passed my loan to their subsidiary National Collegiate Trust…

They cited that my (notice to them) was over 60 days late and the loan was in repayment and refused to negotiate. Then, when I called/wrote/emailed NCT to negotiate, they sent my loan to another subsidiary— their collection agency MRS.

These companies are working together and when students are full-time in school, they bombard them with calls and deadlines and capitalize by taking punitive measures such as outlined above, from which they no doubt profit.

…I believe that a lot of students have had loans placed at (a) collection agency while they are full-time in school. This should be amended to allow students wiggle room to complete their studies stress-free. If students graduate, find employment and refuse to pay, only then collections should be appropriate.”

Tags: college graduates, debt burden, debt crisis, federal loans, forbearance, private debt, private loans, profit school, student debt, student loan debt, variable interest rates

Posted in Financial Planning Rockville, Latest News |

No Comments »

Posted on: October 28th, 2012 by Amy Bolger

The healthcare reform bill, often referred to as “Obamacare”, doesn’t mean a lot to workers who receive employer-sponsored coverage, but for those that buy individual insurance on the open market, it changed a lot. Six months after enactment, health insurers could not place lifetime limits on the value of coverage or revoke existing coverage. Starting in 2014, however, insurers must accept all applicants, including anyone with preexisting conditions. Until then, individuals with preexisting conditions who have been uninsured for more than 6 months will be eligible to enroll in the national high-risk pool and receive subsidized premiums. The healthcare reform bill, often referred to as “Obamacare”, doesn’t mean a lot to workers who receive employer-sponsored coverage, but for those that buy individual insurance on the open market, it changed a lot. Six months after enactment, health insurers could not place lifetime limits on the value of coverage or revoke existing coverage. Starting in 2014, however, insurers must accept all applicants, including anyone with preexisting conditions. Until then, individuals with preexisting conditions who have been uninsured for more than 6 months will be eligible to enroll in the national high-risk pool and receive subsidized premiums.

Another big change that effected this population was the requirement to be insured or face a monetary penalty. Early retirees and self employed individuals have to be able to purchase coverage through state based plans. Tax credits are now made available to individuals and families with income between 133-400% of the poverty line. You should speak to your local CPA about these tax credits.

Lastly, if you are 55 years of age and are enrolled in an employer sponsored retiree health plan, your costs could have possibly been lowered. Under the government reinsurance program, employers were reimbursed for 80% of retiree claims between $15,000-$90,000. The program will end on January 1, 2014. Speak to your insurance liaison to help pick the most beneficial plan for you.

Tags: health insurers, healthcare reform, individual insurance, preexisting conditions, retiree health plan

Posted in Latest News |

No Comments »

|

|

While all the information collected by the Internal Revenue Service is protected by strict privacy statutes, the federal tax collector is well within his investigative rights to peruse what you choose to make public. So you might want to reconsider bragging on Facebook about buying a Ferrari when you’re reporting just a $30,000 annual income on your Form 1040. Or at least tighten up the privacy controls on your social media account.

While all the information collected by the Internal Revenue Service is protected by strict privacy statutes, the federal tax collector is well within his investigative rights to peruse what you choose to make public. So you might want to reconsider bragging on Facebook about buying a Ferrari when you’re reporting just a $30,000 annual income on your Form 1040. Or at least tighten up the privacy controls on your social media account.